Tag Archives: LEN

Option Trade of the Week – There’s No Place Like Home

June 20, 2023

Have you seen the results for our Option Trade of the Week lately? Last Friday, two more trades – an iron condor on TLT and call credit spread on NEE – expired worthless for an average gain of 32%. That makes 10 winners in the last 11 trades! I hope you’re taking advantage of these profit makers.

Here’s your Option Trade of the Week as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This is a post-earnings bullish trade on a stock we’ve converted into gains of 55% and 28% in previous weekly trades. The stock didn’t do much today, so you should be able to get close to the price my members pocketed today.

Good luck with the trade!

There’s No Place Like Home

Sticking with a past winner is never a bad strategy. That’s why this week I’m going to make this very simple. I’m going with another bullish play on a stock we’ve successively traded twice within the past 9 months for gains of 28% and 55%. It’s on homebuilder Lennar (LEN), which once again blew the front doors off expectations with this week’s earnings report.

Although revenue and income fell from a year earlier, both came in well above the consensus analyst estimate … by a lot. Earnings per share came in 29% above the estimate, while revenue beat by more than a billion dollars. Home deliveries beat the projection by 9%. And to complete the blowout, LEN raised its fiscal Q3 and full-year delivery estimates well above the analyst forecast.

Analysts responded with a flurry of target price increases, though none was willing to upgrade the stock. It’s hard to get a handle on analyst sentiment, as different sources offer widely divergent data. Yahoo!Finance claims the average rating is between a buy and hold, while the average target price is $124.47. Benzinga claims the consensus rating is neutral and the average target is $95.92. With LEN closing at $120 on Friday, it’s safe to say that neither target price nor average rating is optimistic.

But I’m fine with that. I suppose analysts are looking at interest rates and guessing that home buyers will wait for the Fed to pivot lower (good luck with that). But resale inventory is low as homeowners are trapped into keeping their lower interest-rate mortgages. That frees up demand for new homes. At some point, analysts should recognize LEN’s longer-term potential and free up a few ratings upgrades. That should give the shares a boost.

That’s what we’re seeing on LEN’s chart, which shows the stock nearly doubling its year-ago price. In fact, the shares hit an all-time high on Friday. Unlike some stocks – chips, for example – LEN’s gains have been steady, guided higher by both the 20-day and 50-day moving averages. I can’t use those trendlines to pick the short strike of our put spread because the stock rallied late in the week. But I can use recent highs near the 116 level as a potential site of support.

If you agree that LEN will continue to gain on the strength of its fundamentals, consider the following credit spread trade that relies on the stock staying above 116 (blue line) through expiration in 6 weeks:

Buy to Open the LEN 28 Jul 114 put (LEN230728P114)

Sell to Open the LEN 28 Jul 116 put (LEN230728P116) for a credit of $0.50 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $120.02 close. Unless LEN surges at the open on Tuesday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $200, making your net investment $151.30 per spread ($200 – $48.70). If LEN closes above 116 on July 28, both options will expire worthless and your return on the spread would be 32% ($48.70/$151.30).

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – If You Build It …

March 20, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. It was another post-earnings play, a strategy we’ve had success with of late.

Before getting to the trade, I wanted to let you know that the Terry’s Tips portfolios are gaining steam. The combined four portfolios are beating the S&P 500, led by the Honey Badger portfolio (it trades QQQ options), which is up a whopping 19% so far this year! Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips that includes …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

If You Build It …

They will buy. At least that’s what homebuilders think based on the latest builder confidence survey, which ticked higher for the third month in a row. On Wednesday, the Census Bureau will release February’s residential construction numbers, and the market is expecting gains in starts and completions.

On the company level, Lennar (LEN) reported earnings this week that easily beat on the top and bottom lines. The company also projected home sales for next quarter and the full year that are higher than the consensus analyst estimates. The stock received several target price increases, though no ratings upgrades. The average target price is about 10% above Friday’s close, while the average rating is between a buy and hold. Given that the stock is up nearly 50% in the past five months, it seems some analysts are behind the curve.

The stock is currently riding along the support of its 50-day moving average which came into play after a pullback from a 52-week high hit in early February. The stock pulled away from this trendline after the earnings report, though not far enough to take its support out of play.

Note that the short strike of our put spread is below the 50-day (blue line) and the 20-day (red line), which has turned higher. Thus, the stock will have two pierce two levels of support to move the spread into the money.

If you agree that LEN will maintain its long-term uptrend, using the support of its 50-day and 20-day moving averages, consider the following trade that relies on the stock staying above $97.5 (green line) through expiration in 5 weeks:

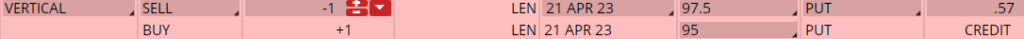

Buy to Open the LEN 21 Apr 95 put (LEN230421P95)

Sell to Open the LEN 21 Apr 97.5 put (LEN230421P97.5) for a credit of $0.55 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $103.50 close. Unless LEN surges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $53.70. This trade reduces your buying power by $250, making your net investment $196.30 per spread ($250 – $53.70). If LEN closes above $97.50 on Apr. 21, both options will expire worthless and your return on the spread would be 27% ($53.70/$196.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube