Tag Archives: Bullish Options strategies

Option Trade of the Week – Fool Me Once … (VEEV)

April 1, 2024

Fool Me Once …

There was nothing on the weekly earnings docket that I considered trade worthy. Even the few names I recognized were either too low-priced, had lousy options or bid/ask spreads, or, most importantly, not giving me a good chart read. During slow earnings periods – which include next week and most of the following week – I look back at past trades to see how they look today. One that I like just happens to be the last trade we closed for a loss. But I whiffed so badly on it – I suggested a bearish trade and the stock cruised 20% higher – that I now like it as a bullish play.

The stock is Veeva Systems (VEEV), which provides cloud-based software for the health sciences industry. VEEV reported solid earnings results in late February, beating estimates on revenue and earnings per share. Guidance for the first quarter came up short on revenue, which may be why the stock stumbled a bit after the report.

Analysts were very clear in their view toward VEEV, handing the stock a boatload of target price increases. Maybe they’re trying to play catch-up because the current average target price – after all the increases – is right around Thursday’s closing price. Given that VEEV is a tech stock (though it’s considered in the healthcare sector), that’s an underwhelming endorsement for a stock that’s rallied 40% in less than four months. It’s not hard to see how more target price increases and perhaps a ratings change or two (the current average rating is a buy) could be in the offing.

There aren’t many charts prettier than VEEV’s daily chart. The stock has climbed steadily since an early December low, riding along the solid support of its 20-day moving average. How solid? The trendline has been tested no less than a half-dozen times and has allowed just one daily close below it. This trade is based on the uptrend and support continuing for the next several weeks, perhaps aided by some analyst love.

The 20-day moving average sits just below the 230 level, while the 50-day is at 220. VEEV offers only monthly options, with strikes every 10 points within the range we want. Therefore, I am forced to go with the May series and the 220 short strike. This is producing a little less credit – and thus return – compared to our usual trades. But that means the short strike is further out of the money (less risky).

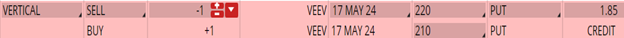

If you agree that the stock will continue to trade above its 20-day (blue line) moving average, consider the following credit spread trade that relies on VEEV staying above $220 (red line) through expiration in 7 weeks:

Buy to Open the VEEV 17 May 210 put (VEEV240517P210)

Sell to Open the VEEV 17 May 220 put (VEEV240517P220) for a credit of $1.80 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $231.69 close. Unless VEEV surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $178.70. This trade reduces your buying power by $1,000, making your net investment $821.30 per spread ($1,000 – $178.70). If VEEV closes above $220 on May 17, the options will expire worthless and your return on the spread would be 22% ($178.70/$821.30).

** We are crushing it! Our Costco (COST) portfolio was up 30% in the first quarter. Our Microsoft (MSFT) portfolio gained 15% (last year this portfolio returned more than 70%). And our IWM portfolio added nearly 20%. All in just one quarter.

Don’t be left behind … there’s still time to save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Free Option Trade of the Week – Sunny Outlook (FSLR)

March 5, 2024

Sunny Outlook

We’re headed back to the bullish side this week with a trade on First Solar (FSLR). The country’s largest solar module maker reported earnings on Tuesday after the bell. Earnings per share came in above estimates, while revenue fell short despite growing more than 15% year over year. The company guided earnings and sales that were in line with or slightly higher than the analyst consensus.

The stock jumped as much as 9% on the news before closing 3% higher. That’s in sharp contrast to other solar companies, which have been plagued by lower demand, high interest rates, regulatory changes and higher inventories. But FSLR managed to overcome those headwinds with stronger pricing power, something analysts see continuing in 2024.

The news was not met with any ratings changes, though there were a few target price increases. Depending on the source, FSLR’s average target price is in the $210-235 range, which is well above Friday’s $158 close. Given that the stock reached a high of $232 last May – its highest level in the past 25 years – these estimates may be a tad overexuberant.

My take on FSLR – based on the charts – is more conservative. The stock has gone nowhere in the past five months, travelling mostly between the 140 and 175 levels. The 20-day and 50-day moving averages, which have provided nothing in terms of support or resistance, are horizontal and of little use.

Given the positive earnings results and outlook, we’re looking for the bottom of this trading range continuing to hold at 140, a level the stock has closed below just seven times going back to October 2022. The short strike of our put spread is at 140, which is more than 11% below Friday’s close. Because we’re going so far OTM with this trade, the credit and max return are somewhat lower than most of our trades. Less risk, less reward.

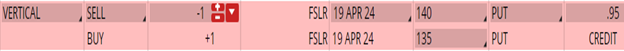

If you agree that the stock will continue respecting the bottom of its trading range, consider the following credit spread trade that relies on FSLR staying above $140 (blue line) through expiration in 7 weeks:

Buy to Open the FSLR 19 Apr 135 put (FSLR240419P135)

Sell to Open the FSLR 19 Apr 140 put (FSLR240419P140) for a credit of $0.90 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $158.05 close. Unless FSLR surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $88.70. This trade reduces your buying power by $500, making your net investment $411.30 per spread ($500 – $88.70). If FSLR closes above $140 on Apr. 19, the options will expire worthless and your return on the spread would be 22% ($88.70/$411.30).

** We are crushing it! Our Costco (COST) portfolio is up 23% already this year. Our Microsoft (MSFT) portfolio is up 14% (last year this portfolio returned more than 70%). Don’t be left behind … there’s still time to save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Room to Run

August 7, 2023

Room to Run

Although this was the busiest week of earnings season – loaded with big tech names – we’re going to wade into calmer waters with Marriott International (MAR). The company runs the gamut of hotel offerings, operating under 30 brand names in 138 countries. The company reported on Tuesday before the open, beating estimates on both revenue and earnings. The hotelier also raised its Q3 and FY 23 earnings projections, which also are above expectations. MAR’s CFO noted that domestic travel demand continues to grow while international markets are starting to heat up. Business and group travel is also improving.

Analysts were less than ebullient toward the news, however. While the stock received several target price increases, there were no ratings changes. In fact, MAR’s average analyst rating sits between a buy and hold. The average target price ranges from $203 (right on its current price) down to $177, depending on the data source. And this is after the target increases. Either way, this is at best a sluggish endorsement of the stock, which is consistent with the ratings.

In contrast, MAR’s chart tells a more bullish story. The stock traded slightly higher after earnings through Friday amid a lower market. But the shares are up 36% in 2023, putting it on par with MSFT. Since late June, MAR has been on a solid rally covering 19% that included an all-time high on Wednesday. Currently, the stock has been trading well above its 20-day moving average, a trendline the stock has stayed close to throughout the runup. Note that the short strike of our put spread is at 195, a mark the 20-day just moved through.

This trade is based on MAR’s positive outlook, support from the 20-day moving average and analysts (hopefully) realizing that they have been too cautious toward the stock. MAR’s performance this year deserves better than what analysts have grudgingly offered.

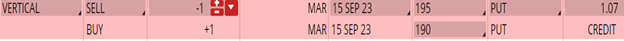

If you agree that the stock will continue to respect its trendline support (blue line), consider the following credit spread trade that relies on MAR staying above $195 (red line) through expiration in 6 weeks:

Buy to Open the MAR 15 Sep 190 put (MAR230915P190)

Sell to Open the MAR 15 Sep 195 put (MAR230915P195) for a credit of $1.05 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $202.98 close. Unless MAR surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $500, making your net investment $396.30 per spread ($500 – $103.70). If MAR closes above $195 on Sep. 15, the options will expire worthless and your return on the spread would be 26% ($103.70/$396.30).

**We are crushing it! Subscribers had another great week after enjoying their best week in 3 years thanks to a monster 40% profit in our MSFT portfolio. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – We Want Profits, NOW!

August 1, 2023

With earnings season now at its peak, there were plenty of opportunities this week. I wanted to return to the bullish side with a stock that posted solid results that were not reflected in the price action. The best candidate I found was cloud platform provider ServiceNow (NOW). NOW reported after the bell on Wednesday, and there was nothing to complain about. Earnings and revenue were up sharply, and both beat estimates. The company raised its quarterly and full-year subscription revenue forecasts above the Street consensus. Moreover, NOW unveiled two major additions to its suite of AI software.

Analysts were clearly impressed with the news, as there was a flurry of target price increases. Despite these raises, the consensus target price is only 5-10% above Friday’s close, which is not much for a tech name. There were no ratings upgrades, probably because most analysts are already in the “buy” camp.

Despite the impressive results and news, the stock slumped on Thursday, falling 3%. That pulled the stock down to the support of its 50-day moving average, a trendline NOW last closed below in early May. The 50-day has guided the stock higher throughout 2023, helping it to a 47% gain for the year. This trade is based on the 50-day support holding through the next several weeks. Accordingly, the short put strike of our credit spread sits just below the trendline.

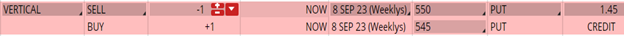

If you agree that the stock will continue to respect its trendline support (blue line), consider the following credit spread trade that relies on NOW staying above $550 (red line) through expiration in 6 weeks:

Buy to Open the NOW 8 Sep 545 put (NOW230908P545)

Sell to Open the NOW 8 Sep 550 put (NOW230908P550) for a credit of $1.40 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $569.54 close. Unless NOW surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $138.70. This trade reduces your buying power by $500, making your net investment $361.30 per spread ($500 – $138.70). If NOW closes above $550 on Sep. 8, the options will expire worthless and your return on the spread would be 38% ($138.70/$361.30).

**We are crushing it! Subscribers just had their best week in 3 years thanks to a monster 40% profit in our MSFT portfolio. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Chip off the Old Blox

Chip off the Old BLOX

Looking back on recent trades in this space, we’re a little heavy on the bearish side of the ledger. Without forecasting where the market is headed (I don’t do forecasts), I feel that we need a put spread to inject some bullishness. One name that recently popped up is Roblox (RBLX), an online entertainment platform provider.

RBLX reported earnings last week that were mixed. The company suffered a wider loss than a year earlier, which came in lower than analysts were expecting. But revenue came in higher than estimates. One important metric for RBLX is bookings, which grew 22% for the quarter and beat the analyst forecast. The stock jumped 10% in the ensuing two days, pushing it above both its 20-day and 200-day moving average. The shares have traded sideways since then and currently sit between the 20-day and 50-day moving averages.

Analysts mostly cheered the earnings news, giving the stock a couple of upgrades and a few target price increases (there was one decrease). But overall, analysts are lukewarm toward the shares, averaging between a buy and hold. The average target price is also underwhelming, sitting just 6% above Friday’s close. But I’m OK with that because it tells me there’s ample room for upgrades. That’s evident from the two upgrades we saw last week even though the company fell short of the earnings estimate.

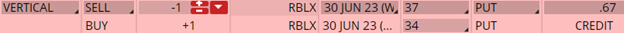

This trade is based on RBLX benefiting from its bookings strength and perhaps some more love from analysts. We’re going with a neutral-to-bullish put spread on RBLX with the short put strike (green line) below both the 20-day (blue line) and 200-day (red line) moving averages. If you agree that RBLX will stay atop these trendlines, consider the following credit spread trade that relies on the stock staying above $37 through expiration in 6 weeks:

Buy to Open the RBLX 30 Jun 34 put (RBLX230630P34)

Sell to Open the RBLX 30 Jun 37 put (RBLX230630P37) for a credit of $0.65 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $40.01 close. Unless RBLX surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $63.70. This trade reduces your buying power by $300, making your net investment $236.30 per spread ($300 – $63.70). If RBLX closes above $37 on June 30, all options will expire worthless and your return on the spread would be 27% ($63.70/$236.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Regional Survival

April 24, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This is an ETF trade that closed flat today, so you can enter the position at about the same price as my Insiders. Good luck with the trade!

But first, it’s time for my usual pitch for our premium Terry’s Tips service. We’re solidly in the black this year, led by our Honey Badger portfolio (it trades QQQ options), which is up an impressive 23.8%. Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Regional Survival

Earnings season is now in full swing, and one sector that appears to have made it through the gauntlet with modest bruising is the smaller banks. Few sectors have attracted as much attention lately, thanks to the failings of SVB and a few others. But a bad apple or two doesn’t have to spoil the bunch. And that seems to be the case with the smaller, regional banks, most of which have reported earnings.

Most stocks in this sector tend to have only monthly options, limited strike prices and poorer liquidity. So, instead of picking one name, let’s pick ‘em all with the SPDR S&P Regional Banking ETF (KRE). KRE is an equal-weighted index of regional US banking stocks, with New York Community Bancorp (NYCB), M&T Bank (MTB) and Huntington Bancshares (HBAN) among its top holdings. According to ETF.com, only 21% of KRE’s 145 holdings have market caps above $13 billion.

Most banks – large and small – have reported earnings. In fact, nine of KRE’s top 10 holdings have entered the earnings confessional, with most flying under the radar. And KRE has gone exactly nowhere. After tanking in early March when the SVB shenanigans hit the news, the ETF has traded sideways right through its primary earnings period. That shouldn’t be a surprise, since KRE had traded flat for an entire year prior to the March ugliness.

Since last month’s swoon, KRE has traded mostly in a range between the 41 and 45 levels. Currently, it’s hugging its 20-day moving average, which also is flat. When the 20-day is horizontal, you know not much is happening. That’s why I’m going with a put spread with the short put at the bottom of the current range. This trade is not about KRE taking off in the next few weeks. It’s a defensive play based on the range holding and KRE continuing sideways now that earnings are over.

What I like about the trade is that while KRE’s historical volatility has declined for the past month, KRE’s implied volatility (IV) has stayed steady. In other words, options are pricing in future moves that are greater than what KRE has recently shown. That suggests to me that options are overpriced, which is what we look for when selling premium with our credit spreads.

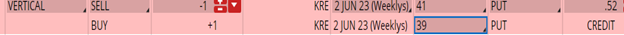

If you agree that KRE will hold at its 20-day moving average (blue line) and respect the lower rail of its trading range for the next few weeks, consider the following trade that relies on the ETF staying above $41 (red line) through expiration in 6 weeks:

Buy to Open the KRE 2 Jun 39 put (KRE230602P39)

Sell to Open the KRE 2 Jun 41 put (KRE230602P41) for a credit of $0.50 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $42.93 close. Unless KRE jumps at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $200, making your net investment $151.30 per spread ($200 – $48.70). If KRE closes above $41 on June 2, both options will expire worthless and your return on the spread would be 32% ($48.70/$151.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for the very smart yet understandable way to trade options? Look no further.

~ Phil Wells

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Here’s The Beef

March 27, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. It was another post-earnings play, this time on a restaurant stock. Good luck with the trade!

Bright emotions, sweet victories and thrills await you after registering on the Pin Up casino website https://casinopinup.com.tr. This is a top licensed online gambling club with a large selection of slots, virtual roulette, live games, and sports betting is also available to customers. Pleasantly surprised by the varied bonus program with rewards for registration, account replenishment, loss, with regular free spins, tournaments and lotteries.

Terry’s Tips portfolios are on fire! The combined four portfolios had their best week in six weeks and have more than doubled the return of the S&P 500. The Honey Badger portfolio (it trades QQQ options) is up a whopping 24% so far this year! Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Here’s The Beef

Darden Restaurants (DRI) – a sit-down restaurant chain conglomerate that includes Olive Garden, LongHorn Steakhouse and Capital Grille – reported earnings this week that beat on virtually every measure. Not only did the company top earnings and sales estimates, same-store sales growth also came in above expectations. And DRI upped guidance above the expected range. The company claimed that raising prices less than the rate of inflation drove higher sales.

Analysts cheered the news, though none upgraded the stock. Price target increases were plentiful, pushing the average to $159. But that’s hardly ebullient, as it sits just 4% above Friday’s closing price. That seems reasonable, however, unlike many so-called “growth” stocks.

The stock dropped less than half a percent after the report. Perhaps that’s because it rallied into earnings, a move that broke above a trading range that had contained the shares for much of this year. Despite the range, the stock has been in an overall uptrend since June, rising nearly 40%. The 50-day moving average has guided this rally, although here have been dips below it, the most recent coming earlier this month.

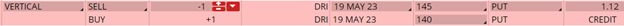

This trade is not necessarily a bet that DRI will continue rising. It’s more a defensive play that the stock will not suffer a serious decline and will remain above the 50-day (blue line) and the bottom of the recent trading range. We’re going a little further out of the money with the short put strike to add a measure of safety. That, of course, means the credit is less. Note that we are going out eight weeks, as DRI does not have weekly options.

If you agree that DRI will continue to trade in a range – or at least not weaken – consider the following trade that relies on the stock staying above $145 (red line) through expiration in 8 weeks:

Buy to Open the DRI 19 May 140 put (DRI230519P140)

Sell to Open the DRI 19 May 145 put (DRI230519P145) for a credit of $1.10 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $152.58 close. Unless DRI surges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $108.70. This trade reduces your buying power by $500, making your net investment $391.30 per spread ($500 – $108.70). If DRI closes above $145 on May 19, both options will expire worthless and your return on the spread would be 28% ($108.70/$391.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. – Maya

Any questions? Email Terry@terrystips.com.

Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – If You Build It …

March 20, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. It was another post-earnings play, a strategy we’ve had success with of late.

Before getting to the trade, I wanted to let you know that the Terry’s Tips portfolios are gaining steam. The combined four portfolios are beating the S&P 500, led by the Honey Badger portfolio (it trades QQQ options), which is up a whopping 19% so far this year! Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips that includes …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

If You Build It …

They will buy. At least that’s what homebuilders think based on the latest builder confidence survey, which ticked higher for the third month in a row. On Wednesday, the Census Bureau will release February’s residential construction numbers, and the market is expecting gains in starts and completions.

On the company level, Lennar (LEN) reported earnings this week that easily beat on the top and bottom lines. The company also projected home sales for next quarter and the full year that are higher than the consensus analyst estimates. The stock received several target price increases, though no ratings upgrades. The average target price is about 10% above Friday’s close, while the average rating is between a buy and hold. Given that the stock is up nearly 50% in the past five months, it seems some analysts are behind the curve.

The stock is currently riding along the support of its 50-day moving average which came into play after a pullback from a 52-week high hit in early February. The stock pulled away from this trendline after the earnings report, though not far enough to take its support out of play.

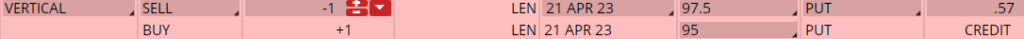

Note that the short strike of our put spread is below the 50-day (blue line) and the 20-day (red line), which has turned higher. Thus, the stock will have two pierce two levels of support to move the spread into the money.

If you agree that LEN will maintain its long-term uptrend, using the support of its 50-day and 20-day moving averages, consider the following trade that relies on the stock staying above $97.5 (green line) through expiration in 5 weeks:

Buy to Open the LEN 21 Apr 95 put (LEN230421P95)

Sell to Open the LEN 21 Apr 97.5 put (LEN230421P97.5) for a credit of $0.55 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $103.50 close. Unless LEN surges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $53.70. This trade reduces your buying power by $250, making your net investment $196.30 per spread ($250 – $53.70). If LEN closes above $97.50 on Apr. 21, both options will expire worthless and your return on the spread would be 27% ($53.70/$196.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Going With The Science

February 8, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of the Saturday Report. Being in the heart of earnings season, we again had several solid opportunities to choose from this week. We’re going scientific this week with another bullish play.

Before getting to the trade, I want you to know that we are extending our huge discount offer to join Terry’s Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We’re still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Going With The Science

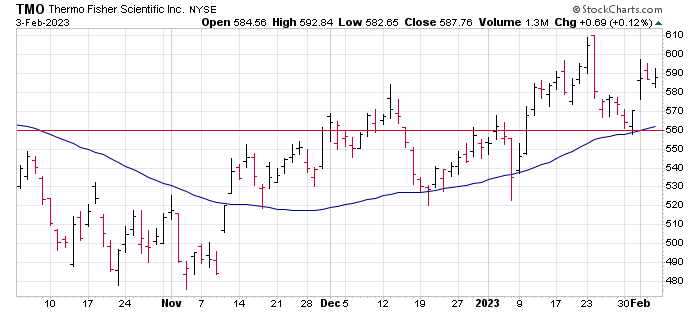

Thermo Fisher Scientific (TMO) provides analytical instruments, diagnostics and lab products for life sciences research. Before the bell on Wednesday, the company reported earnings that easily beat estimates on both revenue and earnings per share (EPS). However, EPS fell from a year earlier, while operating margins contracted.

Analysts were apparently impressed by the report, as the stock was hit with a wave of target price increases. There were no rating upgrades, though perhaps that’s because analysts are already bullish on the stock.

The stock reacted by moving 3% higher on Wednesday. That may not sound like much, but TMO has a history of subdued moves after earnings. In fact, it was the second-largest one-day move since April 2021. More importantly, though, is the fact that the shares bounced off their 50-day moving average to continue a rally that has seen TMO gain 23% off a Nov. 2 low. Moreover, the stock is now sitting above its 20-day moving average.

The 50-day moving average is the key to this trade, as the stock has closed below this trendline just once since crossing above it in mid-November. We’re counting on this support, as the short strike of our put spread sits just below the 50-day.

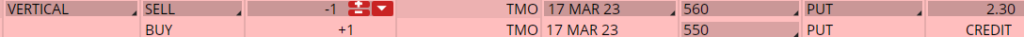

If you agree that TMO will continue to rally along the support of its 50-day moving average (blue line), consider the following trade that relies on the stock staying above $560 (red line) through expiration in 6 weeks:

Buy to Open the TMO 17 Mar 550 put (TMO230317P550)

Sell to Open the TMO 17 Mar 560 put (TMO230317P560) for a credit of $2.25 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $587.76 close. Unless TMO rises quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $223.70. This trade reduces your buying power by $1,000, making your net investment $776.30 per spread ($1,000 – $223.70). If TMO closes above $560 on Mar. 17, both options will expire worthless and your return on the spread would be 29% ($223.70/$776.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. – Maya

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Feeling Chipper

February 1, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of the Saturday Report. With earnings season in full swing, we had lots to choose from this week. We’re back in the chip sector with a bullish play.

Before getting to the trade, there’s still time to jump on our huge discount offer to join Terry’s Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We’re still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us in 2023! Now on to the trade …

Feeling Chipper

KLA Corp. (KLAC) provides process-control technology to the semiconductor industry. The company reported earnings after the bell on Thursday that beat estimates on both the top and bottom lines. But the fly in the ointment came in the form of a lowered outlook for the third quarter that fell below expectations. The stock fell nearly 7% on Friday, its largest one-day, post-earnings decline in eight years.

So, why the optimism? First, analysts didn’t seem all that concerned. While there was one downgrade on the news, the stock was hit with several target price increases. The current average price target for KLAC is only about 8% above Friday’s close. That’s far from unreasonable given how analysts usually are more ebullient toward tech names. And the average analyst rating is a moderate buy, which leaves room for future upgrades.

Second, KLAC’s chart shows that Friday’s plunge, while perhaps unsettling, did not signal the end of the stock’s current strong rally. Even with the Friday drop, the stock has gained 60% in just three months. The rally has been guided by the combined support of the 20-day and 50-day moving averages. The 50-day is the key to this trade, however, as it has not allowed a daily close below it since early November. It also served as key support during a pullback in late December. Note that the short strike of our put spread is below the 50-day, so the stock will have to pierce this support to move the spread into the money.

Third, while the early returns on chip stocks (including Intel this week) suggest some rougher waters next quarter, the sector as a whole is rallying. The VanEck Semiconductor ETF (SMH) has been on a strong, month-long rally and hit a five-month high during Friday’s session.

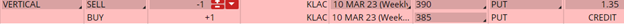

If you agree that KLAC will continue to find support at its 50-day moving average (blue line), consider the following trade that relies on the stock staying above $390 (red line) through expiration in 6 weeks:

Buy to Open the KLAC 10 Mar 385 put (KLAC230310P385)

Sell to Open the KLAC 10 Mar 390 put (KLAC230310P390) for a credit of $1.30 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $399.37 close. Unless KLAC rises quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $128.70. This trade reduces your buying power by $500, making your net investment $371.30 per spread ($500 – $128.70). If KLAC closes above $390 on Mar. 10, both options will expire worthless and your return on the spread would be 35% ($128.70/$371.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you.

~ Maya

Thank you again for being a part of the Terry’s Tips newsletter. Any questions? Email Terry@terrystips.com

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube