Tag Archives: Bearish Options Strategies

Housing Poor

Housing Poor

Homebuilding stocks got a boost early in the week after a prominent housing analyst upgraded the entire sector, including a rare “double upgrade” for Lennar (LEN) from underweight to overweight. The rationale was that housing tends to outperform coming out of a bear market and that “early pain = early gain.”

Now, he could very well be right … at some point. Housing stocks, along with the broader market, will eventually pull out of this bear market. But that’s off in the future. We’re still in the “early pain” phase.

LEN got a boost from the news but then trended lower after a mixed earnings report and another 75 bps rate hike from the Fed (with more to come). The stock could not pierce its declining 20-day moving average (blue line), which has kept a lid on LEN’s rally attempts after turning lower two months ago. Furthermore, the 50-day moving average (red line), which is now headed lower, sits overhead, ready to provide resistance.

This trade is based on more “early pain” for the homebuilders based on rising interest rates, mortgage rates at 14-year highs and the looming prospect of a recession. We are playing a call credit spread with the short call sitting above the 50-day, meaning that LEN will have to overcome two points of resistance to move the spread into the money.

If you agree that LEN will continue to slide lower, consider the following trade that relies on the stock staying below $82 (green line) through expiration in six weeks:

Buy to Open the LEN 4Nov 85 call (LEN221104C85)

Sell to Open the LEN 4Nov 82 call (LEN221104C82) for a credit of $1.05 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $77.07 close. Unless LEN sags quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $300, making your net investment $196.30 per spread ($300 – $103.70). If LEN closes below $82 on Nov. 4, both options will expire worthless and your return on the spread would be 53% ($103.70/$196.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Pumped Up

Pumped Up

Much is made of gas prices declining for so many weeks in a row (I think we’re at 13 and counting). And that’s great for drivers. But what about the oil companies. Don’t they suffer when pump prices decline? Apparently not.

Gas prices peaked in mid-June and have dropped about 25% since then. But Chevron (CVX) has gained more than 5% during that period. For the year, CVX is up 33%. Its only major blip this year was the June swoon that pulled all stocks lower. But the decline was supported by the 200-day moving average, which allowed just a handful of daily closes below it in mid-July.

This trade is based on the strength of oil companies continuing for the next couple of months. More specifically, it is relying on the continued support of the 200-day. Note that the short put of our spread is right on the 200-day (blue line) and will be below it given the trendline’s current slope. Thus, CVX will have to penetrate that support to move the spread into the money.

If you agree that CVX will respect the 200-day, consider the following trade that relies on the stock staying above $148 (red line) through expiration in six weeks:

Buy to Open the CVX 28Oct 145 put (CVX221028P145)

Sell to Open the CVX 28Oct 148 put (CVX221028P148) for a credit of $0.75 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $156.45 close. Unless CVX pops quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $73.70. This trade reduces your buying power by $300, making your net investment $226.30 per spread ($300 – $73.70). If CVX closes above $148 on October 28, both options will expire worthless and your return on the spread would be 33% ($73.70/$226.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

It’s Getting Cold in Burlington

September 6, 2022

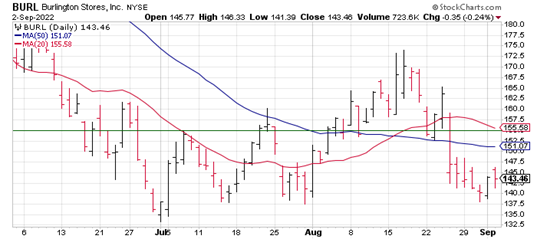

Burlington Stores (BURL) reported earnings on August 25 that beat on profits but missed on revenue. Same-store sales fell 17%, more than analysts expected. The reasons should sound familiar by now – consumers coming under increasing price pressures and too much inventory. More significantly, BURL slashed its quarterly and full-year earnings forecast.

Analysts, as usual, are right on with their assessment of the stock. Despite the price being cut in half this year, BURL has an average “buy” rating. I’m not sure what chart they’re looking at. In fact, there are more “buy” and “strong buy” ratings now than in June. Go figure. To their credit, most analysts lowered their price targets for the off-price retailer. But the average target of $176 is still 23% above Friday’s close.

The stock was hammered after the report, dropping 10% to fall below both the 50-day (blue line) and 20-day (red line) moving averages. And it hasn’t recovered since then. We are thus playing a bearish credit spread with the short call (green line) sitting on the 20-day moving average, which is rolling over. Thus, the stock will have to break above two points of resistance to move the spread into the money.

If you agree that BURL will struggle to break through resistance, consider the following trade that relies on the stock staying below $155 through expiration in seven weeks:

Buy to Open the BURL 21Oct 160 call (BURL221021C160)

Sell to Open the BURL 21Oct 155 call (BURL221021C155) for a credit of $1.55 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $143.46 close. Unless BURL falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $153.70. This trade reduces your buying power by $500, making your net investment $346.30 per spread ($500 – $153.70). If BURL closes below $155 on October 21, both options will expire worthless and your return on the spread would be 44% ($153.70/$346.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

For Whom the Bear Tolls

August 29 2022

For Whom the Bear Tolls

This is not a great time to be a homebuilder. The housing boom is over by most accounts. Consumer confidence in the housing market dropped to its lowest point since 2011. Sales of new homes plunged to a 6-1/2-year low in July. The Fed is not letting up on its interest-rate crusade. Do I need to go on?

Toll Brothers (TOL) echoed this sentiment in its recent earnings report. Although net income rose sharply in the third quarter and beat the analyst consensus estimate, revenue came up a bit short. More importantly, the homebuilder expects to deliver about 1,000 fewer units in fiscal 2022 than previously estimated.

TOL didn’t do much after earnings this week. In fact, it hasn’t done much for the past several months. The stock has been trading sideways for five months, with the top of the range around the $50 level. The fact that the shares couldn’t gain ground when housing was hot and interest rates low does not bode well for the future. Thus, we are going with a bearish call spread with the short call at the top of this trading range.

If you agree that TOL will continue sideways at best and lower at worst, consider the following trade that relies on the stock staying below $50 (blue line) through expiration in six weeks:

Buy to Open the TOL 7Oct 52 call (TOL221007C52)

Sell to Open the TOL 7Oct 50 call (TOL221007C50) for a credit of $0.45 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $46.12 close. Unless TOL falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $43.70. This trade reduces your buying power by $200, making your net investment $156.30 per spread ($200 – $43.70). If TOL closes below $50 on October 7, both options will expire worthless and your return on the spread would be 28% ($43.70/$156.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Just Do It … or Not

Nike (NKE) reported earnings on Monday that beat on the top and bottom lines. But many were not impressed, citing disappointing gross margin guidance, among other metrics. The stock was hit with a slew of target price downgrades, though that’s been the norm for all stocks as analysts make feeble attempts to catch up with the bear market. Nevertheless, saying analyst reactions were mixed would probably be an overstatement. The stock reacted by crashing to a two-year low and falling 45% from its November high. Given the current market environment and the latest numbers, it’s difficult to make a bullish case for the stock over the near term. So, we won’t. That said, we’re giving plenty of room on the upside, using a call spread with the short call sitting just below the declining 20-day moving average (red line), which twice rebuffed rally attempts in June. The 50-day moving average (blue line) is also in play as potential resistance.

If you agree that NKE will continue its overall downtrend, consider the following trade that relies on the stock staying below $110 (green line) through expiration in seven weeks.

Buy to Open NKE 19Aug 115 call (NKE220819C115)

Sell to Open NKE 19Aug 110 call (NKE220819C110) for a credit of $1.05 (selling a vertical)

This credit is $0.02 less than the mid-point of the option spread when NKE was trading at $101. Unless the stock drops quickly from here, you should be able to get close to this amount.

Your commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $500 and makes your net investment $396.30 ($500 – $103.70) for one spread. If NKE closes below $110 on August 19, both options will expire worthless and your return on the spread would be 26% ($103.70/$396.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Paypal (PYPL) – A Longstanding Favorite Among Analysts

This week we are looking at another of the Investor’s Business Daily (IBD) Top 50 List companies. We use this list in one of our options portfolios to spot outperforming stocks and place option spreads that take advantage of the momentum.

A majority of analysts have consistently given PYPL a Strong Buy rating over the past year, and rightfully so. The stock is up 74% YTD even though it’s down about 13% from the all-time high posted last month. The following two articles shed some light on why investors are drawn to the company: Robinhood Investors Love PayPal. Should They? and Is PayPal Stock A Buy Right Now? Here’s What Earnings, Charts Show.

Technicals

PYPL has mostly traded sideways for the last four months which is not that surprising as stocks often fall into a period of consolidation after a powerful rally. The 100-Day moving average has come into play and while there have been a few days where PYPL traded below it, buyers have been quick to lift the stock back above it. With PYPL trading close to the lower bound of the recent range, this could be an attractive price point to consider a long position.

If you agree there’s further upside ahead for PYPL, consider this trade which relies on the stock remaining above the $185 level through the expiration in five weeks.

Buy To Open PYPL 18DEC20 180 Puts (PYPL201218P180)

Sell To Open PYPL 18DEC20 185 Puts (PYPL201218P185) for a credit of $1.83 (selling a vertical)

This credit is $0.02 less than the mid-point of the option spread when PYPL was trading near $189. Unless the stock rallies quickly from here, you should be able to get close to this amount.

Your commission on this trade will be only $1.30 per spread. Each spread would then yield $181.70. This reduces your buying power by $500 and makes your investment $318.30 ($500 – $181.70). If PYPL closes at any price above $185 on December 18, both options will expire worthless, and your return on the spread would be 57% ($181.70 / $318.30), or 650% annualized.

Changes to Investor’s Business Daily (IBD) Top 50 This Week:

We have found that the Investor’s Business Daily Top 50 List has been a reliable source of stocks that are likely to move higher in the short run. Recent additions to the list might be particularly good choices for this strategy, and deletions might be good indicators for exiting a position that you might already have on that stock.

As with all investments, you should only make option trades with money that you can truly afford to lose.

Happy trading,

Terry

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube