Tag Archives: Bearish Options Strategies

Option Trade of the Week – United We Fall

January 17, 2024

Dear [[firstname]],

It may be a little late, but Happy New Year! I haven’t sent an issue for a while because the credits for our weekly trades weren’t close enough to my target entry prices. As you know, I will not send an issue with a trade you have no chance of entering. This week, however, the credit is higher than when I sent the trade to our premium subscribers, meaning your maximum profit is now greater.

This is my first chance to tell you about the amazing profits we racked up last year. Our QQQ portfolio gained more than 90% for the year, while our MSFT portfolio brought in 70%. We’re on some kind of roll with MSFT, averaging gains of more than 100% over the past 5 years. And 2024 has started the same way … in the profit column.

You can’t afford to miss out on these profits. Resolve to make 2024 your best trading year ever with a subscription to Terry’s Tips.

For our loyal newsletter subscribers (that’s you), I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips. Plus, I’m adding a promise that this rate will never increase. I won’t make this promise forever, though, so now is the time to get in on the action … and profits.

As a Premium Member to Terry’s Tips, you’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions. Trade one portfolio or all four. It’s up to you.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

And for a limited time, I am including a Special Bonus. Terry Allen has condensed his 30 years of options trading experience into an eBook – Making 36% – A Duffer’s Guide to Breaking Par in the Market Every Year, in Good Years and Bad.” Learn a different way to trade using Terry’s unique and decades-tested 10K Strategy. This book is normally $9.98 on our website (and $19.95 on Amazon), but I will personally send you the digital version for free with a paid subscription.

To become a Terry’s Tips Premium Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports and the book.

I look forward to having you join in the fun and profits! Now on to the trade …

United We Fall

Earnings season started this week, though the number of reports was limited. Big banks dominated the headlines, but I didn’t see anything tradeable there. And I was looking for a bearish play to diversify a portfolio that will be all put spreads after this coming Friday.

So, I went with a company that’s bigger – by market cap – than any bank: UnitedHealth Group (UNH). The company reported on Friday, beating expectations for both revenue and income. But a key metric – the medical cost ratio – came in well above estimates. And that proved to be UNH’s undoing, as the stock slumped 3.4% on Friday.

UNH has a half-trillion-dollar market cap, so it gets a lot of analyst coverage. But oddly, there wasn’t a peep from the analyst community on Friday – no ratings changes and no target price moves. Perhaps they were mulling over their overly bullish stance toward the stock.

According to Yahoo! Finance, all 22 rating analysts consider UNH a buy or strong buy. The average target price is around $600, which is 15% above Friday’s close and 7% above the stock’s all-time high, set in October 2022. And it’s not like UNH set the world on fire in 2023. In fact, the stock closed the year a few bucks lower. Maybe we’ll start seeing some analysts ease back on the throttle and temper their targets and ratings, which could put some pressure on the stock.

The price drop on Friday pulled the shares below both their 20-day and 50-day moving averages. For the technical purists, the 20-day (blue line) bearishly crossed below the 50-day (red line) at the end of last year.

I’ve also noted an interesting pattern with UNH. Whatever the stock does the day after earnings tends to be the path for the next several weeks. After the past two earnings reports, the stock gained after earnings and continued to be higher through the subsequent five weeks. The two quarters before that, it was the opposite story – lower the day after earnings and five weeks after earnings. So, if history holds, UNH may find some rough sledding for the next few weeks. Plus, it will have to overcome its short-term moving averages, which are both headed lower.

This week’s bearish call spread has a short strike at the 540 level, which is above both the 20-day and 50-day moving averages. It also sits in an area where the stock has struggled to consistently stay above. Note that this is a 10-point spread because that is the strike increment in the 16Feb series. We’re going with the monthly series because UNH’s weekly options have poorer liquidity. Thus, these spreads will require more buying power, as noted below.

If you agree that the stock will continue to struggle after its earnings slump, consider the following credit spread trade that relies on UNH staying below $540 (green line) through expiration in 5 weeks:

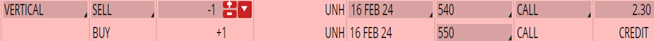

Buy to Open the UNH 16 Feb 550 call (UNH240216C550)

Sell to Open the UNH 16 Feb 540 call (UNH240216C540)

for a credit of $2.20 (selling a vertical)

This credit is $0.10 less than the mid-point price of the spread at Friday’s $521.51 close. Unless UNH falls sharply at the open on Tuesday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $218.70. This trade reduces your buying power by $1,000, making your net investment $781.30 per spread ($1,000 – $218.70). If UNH closes below $540 on Feb 16, the options will expire worthless and your return on the spread would be 8% ($218.70/$781.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. – Maya

Remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. And get Terry’s eBook for free.

Any questions? Email Jon@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Two Option Trades of the Week – GE and SCHW

October 31, 2023

Avast Ye Schwabs

Two call spreads in Estee Lauder (EL) and the SPDR Healthcare ETF (XLV) expired worthless yesterday for gains of 25% apiece. To be fair, our bullish spread on Lululemon Athletica (LULU) expired in the money a week earlier for a larger loss. But the LULU misstep interrupted a string of seven straight winners. A large part of this success has been due to taking a more bearish stance toward the market. In fact, today’s trade marks the fifth straight bearish call spread and eighth of the past 11. And with good reason, as our only losses of the past two months have been bullish positions. We’re on a solid roll. I hope you’re banking some winners.

With earnings season hitting full stride this week, there’s no end to the trade possibilities. Of course, there were the spotlight names, such as Tesla (TSLA) and Netflix (NFLX), whose large post-earnings moves grabbed headlines. But I prefer stocks that have smaller, off-the-radar moves that have a lower likelihood of reversing. One such stock is Charles Schwab (SCHW), which is no stranger to these pages (you may recall I had a few issues with the TD transition in September).

SCHW reported before the open on Monday, so we had a whole week’s worth of post-earnings price action to digest. The numbers were mixed, with net income coming in slightly ahead of expectations while revenue fell a bit short. However, both numbers fell far short of last year’s figures. I won’t bore you by parsing through all the individual data points (bank deposits, net interest revenue, TD migration, new brokerage accounts, etc.). Analysts seem to feel that SCHW still faces several short-term hurdles that have buffeted it all year, though the longer-term prospects are encouraging.

Speaking of analysts, their reaction was much like SCHW’s earnings … mixed. There were no ratings changes while target price changes went both ways. But analysts are clearly bullish on SCHW, giving it a solid buy rating on average. The average target price is near $70, which is around 35% above Friday’s close. This fits into the struggle now, prosper later narrative I mentioned above. But since we’re looking ahead only a few weeks, the bearish case makes more sense.

On the chart, the stock reacted positively to earnings, popping 6% in Monday’s trading before settling for a 4.7% gain. But that was the high close of the week, as the shares tumbled more than 5% after Monday. It’s notable that the 20-day moving average provided staunch resistance throughout the week, containing the initial Monday burst and then sending the stock lower through the week’s end. The 20-day has done a solid job keeping the current decline intact since it rolled over in May. I’ll also note that the stock enjoyed a massive 12.6% spike after its previous earnings report in July, only to give it all back during the subsequent month.

If you agree that the stock will continue its downtrend based on the resistance from its 20-day moving average, consider the following credit spread trade that relies on SCHW staying below $53 through expiration in 6 weeks:

Buy to Open the SCHW 1 Dec 56 call (SCHW231201C56)

Sell to Open the SCHW 1 Dec 53 call (SCHW231201C53) for a credit of $0.75 (selling a vertical)

This credit is $0.09 less than the mid-point price of the spread at Friday’s $50.87 close. Note that I’m giving a little extra room on the entry credit. Unless SCHW falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $73.70. This trade reduces your buying power by $300, making your net investment $226.30 per spread ($300 – $73.70). If SCHW closes below $53 on Dec. 1, the options will expire worthless and your return on the spread would be 33% ($73.70/$226.30).

Low Voltage

We had another spread expire worthless on Friday, but it made us sweat. Adobe (ADBE) was looking great, which was saying something as our only open bullish position. It hit an annual high on Oct. 12, putting the short put nearly 15% out of the money. Then the falling market tide grabbed the stock and pulled it down to within eight points of the short strike at Friday’s close. Another day and it might have moved into the money. But it didn’t and we bagged a gain of over 30% for our eighth winner of the past nine closeouts. That leaves us with five open positions, all bearish call spreads.

I’d love to add a put spread this week, but I can’t make a case for fighting the bearish tape. Maybe next week. For this week, I had way too many earnings plays to choose from, as this was the busiest week of the season. Frankly, I stopped looking after an hour, realizing that I could have spent all day analyzing dozens and dozens of top names.

I settled on General Electric (GE), which may seem like an odd choice given that it had a blowout report and had its best post-earnings day in years. The company easily beat earnings and revenue estimates and raised earnings and revenue growth guidance for 2023. The stock responded with a 6.5% pop on Tuesday, its largest gain after earnings since Jan. 2020. What’s not to like, right?

Well, analysts didn’t seem overly excited. In fact, only two weighed in with target price increases of $1 and $2. That’s it. The average target sits near $126, which is around 19% above Friday’s close. I’ll also point out the last time GE saw $126 was six years ago. There were no ratings changes, which were already heavily slanted toward the buy level. This does not seem like a hearty endorsement of a stock that just had as good an earnings report as you’ll see.

While the shares enjoyed a big gain on Tuesday, the rest of the week didn’t go well. In fact, the stock closed out the week below the pre-earnings close. The dual resistance of the 20-day and 50-day moving averages were in play, as the stock closed the week below both. These trendlines have rolled over into declines, a bad sign given that the stock doesn’t stray far from either. Another factor to note: GE had a big pop of more than 6% after the previous earnings release, but the stock drifted lower after that first day and has never closed a day higher since.

It seems that the earnings effect lasted all of one day and the stock has resumed its downtrend that’s been in place for six weeks. This trade is a bet that the trend will continue, especially in light of the broader market’s weakness. Note that the short call strike sits above Tuesday’s close and the mid-October peak.

If you agree that the stock will continue its downtrend based on the resistance from its 20-day (blue line) and 50-day (red line) moving averages, consider the following credit spread trade that relies on GE staying below $114 (green line) through expiration in 6 weeks:

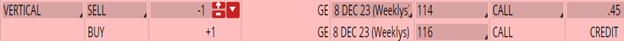

Buy to Open the GE 8 Dec 116 call (GE231208C116)

Sell to Open the GE 8 Dec 114 call (GE231208C114) for a credit of $0.40 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $106.35 close. Note that I’m giving a little extra room on the entry credit. Unless GE falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $38.70. This trade reduces your buying power by $200, making your net investment $161.30 per spread ($200 – $38.70). If GE closes below $114 on Dec. 8, the options will expire worthless and your return on the spread would be 24% ($38.70/$161.30).

**Our QQQ portfolio is up more than 70% in 2023! Our MSFT portfolio is up more than 55%! Don’t be left behind … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Where’s the Beef?

October 10, 2023

With earnings reports virtually dried up this week and wanting to stay on the bearish side, I had to go back a few weeks to find reports that failed to impress the Street. One name that popped up was a stock that we successfully played (28% profit) for a bullish winner back in March – Darden Restaurants (DRI), the sit-down restaurant chain conglomerate that includes Olive Garden, LongHorn Steakhouse, Capital Grille, and the recently acquired Ruth’s Chris Steak House.

DRI reported earnings a couple of weeks ago. The numbers were solid, as the company beat estimates on both the top and bottom lines. Same-restaurant sales also handily beat expectations. Moreover, sales and profits were higher than a year earlier. The only negatives were slowing growth in its fine-dining holdings and some concern over its aggressive expansion plans amid a potential recessionary environment.

Analysts seemed unmoved by the seemingly positive news. The report was met with a mix of target price upgrades and more numerous downgrades. This left the average target in the $160-170 range, well above Friday’s $137 close. With no ratings changes, analysts remain firmly in the buy/outperform camp.

Perhaps analysts should take closer note of DRI’s stock chart and post-earnings performance. After hitting an all-time high in late July, the stock is down 21% and logged its lowest close in nearly a year on Friday. I’ll point out that the S&P 500 is down just 5% over the same time frame. This slump has been perfectly guided by the 20-day moving average, a trendline the stock hasn’t closed above in more than two months. Also, for technical wonks, the 50-day moving average is crossing below the 200-day moving average, also known as the “death cross.”

This bearish trade is based on the stock’s continued slump even after the good earnings results. With analysts perhaps too optimistic, it’s reasonable to expect some target price reductions, if not some ratings downgrades that could further pressure the share price.

Finally, the 20-day resistance is hard to ignore, which is why we’re playing a call spread with the short call strike sitting just above this trendline. Note that this trade has a smaller return than most because I wanted the short strike to be above the 20-day. Thus, we have a larger cushion of safety and greater probability of profit.

If you agree that the stock will continue its downtrend based on the resistance from its 20-day moving average (blue line), consider the following credit spread trade that relies on DRI staying below $145 (red line) through expiration in 6 weeks:

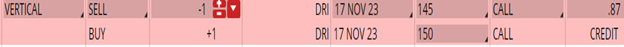

Buy to Open the DRI 17 Nov 150 call (DRI231117C150)

Sell to Open the DRI 17 Nov 145 call (DRI231117C145) for a credit of $0.85 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $136.94 close. Unless DRI falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $83.70. This trade reduces your buying power by $500, making your net investment $416.30 per spread ($500 – $83.70). If DRI closes below $145 on Nov. 17, the options will expire worthless and your return on the spread would be 20% ($83.70/$416.30).

Happy trading,

Jon L

**Our QQQ portfolio is up more than 70% in 2023! Our MSFT portfolio is up around 30%! Overall, we’re beating the S&P. Don’t be left behind … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Cold and Soggy

September 25, 2023

Cold and Soggy

There were a few interesting earnings announcements this week, even though we’re in the quiet period for earnings reports (things start to ramp up again in three weeks). In fact, I had three bearish plays to choose from. That’s a good thing since we currently have three bullish and three bearish trades open, and I feel like the bears need a little more weight after the past week’s Fed-infected price action.

The trade this week is on prepared-food giant General Mills (GIS), which owns several iconic cereal brands along with such names as Betty Crocker, Blue Buffalo, Pillsbury, Progresso, Green Giant and Yoplait. GIS reported earnings numbers on Wednesday before the open that were filled with a lot of “buts.” Sales increased 4% due to higher prices, but volume was lower. Net income beat the consensus expectation but fell 18% from a year ago. GIS executives are bullish on their pet food segment but sales for the quarter were flat. Moreover, some analysts feel that consumers are reaching their limit on rising food costs. And GIS’s CFO said that the company’s operating profit margin will not improve this year.

All in all, it was not a great report, which is perhaps why the stock was hit with a few price target cuts. At least there were no ratings downgrades. Analysts on the whole are neutral toward the stock, while the average target price is in the $70-75 range compared to Friday’s close near $65.

Perhaps analysts would be a bit more skeptical if they took a quick glance at GIS’s chart, which shows the stock plunging 30% in the past four months. This descent has been expertly guided by the 20-day moving average, a trendline the stock has closed above just four times since mid-May. This resistance was evident the two days after earnings this week, when the shares failed to pierce the 20-day with early rallies. Note that the short call strike of our spread sits above this trendline.

If you agree that the stock will continue its downtrend after an uninspiring earnings report and remain below its 20-day moving average (blue line), consider the following credit spread trade that relies on GIS staying below $67.50 (red line) through expiration in 8 weeks:

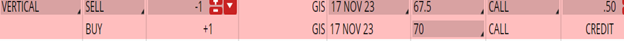

Buy to Open the GIS 17 Nov 70 call (GIS231117C70)

Sell to Open the GIS 17 Nov 67.5 call (GIS231117C67.5) for a credit of $0.45 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $64.82 close. Unless GIS falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $43.70. This trade reduces your buying power by $200, making your net investment $156.30 per spread ($200 – $43.70). If GIS closes below $67.50 on Nov. 17, the options will expire worthless and your return on the spread would be 28% ($43.70/$156.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Smoking Not

July 26, 2023

We’re a bit heavy on the bullish side of the ledger with our open positions. In fact, we have four open put spreads and one neutral iron condor on the books. So, with earnings season in full swing, I was on the hunt for a post-earnings bearish play. It wasn’t easy, though, as most stocks did well after reporting even though they were obscured by the blinding bearish light of NFLX and TSLA.

The pick for this week is Philip Morris International (PM), the tobacco giant that, according to its website, is “building our future on replacing cigarettes with smoke-free products …” These include heated tobacco, e-vapor and oral smokeless products. PM reported earnings on Thursday before the bell that beat estimates for profit and revenue. Smokeless product revenue increased 34% from a year ago. But the full-year earnings outlook fell short of the analyst estimate. Currency exchange rates are also expected to take an 8% to 9.5% chunk out of earnings.

Analysts were oddly silent on PM’s report. In fact, I couldn’t find a single rating mention or price target adjustment for the $150 billion market-cap company (the last one was nearly a month ago). The current view toward PM is firmly bullish, however, while the average price target is around 15% above Friday’s closing price.

With no help from analysts, we turn to the charts. In the two days after earnings, the stock drifted lower by a little more than 1%. For the past year, the shares have done little, netting a gain of less than 2%. The key to this trade is the 100 level, which put a lid on a six-week rally that covered about 13%. This level marked tops in March and April as well. Before that, it served as support from December through mid-February. Based on this history, we’re going with a call spread with the short strike at the 100 level.

If you agree that PM will continue to struggle with this resistance, consider the following credit spread trade that relies on the stock staying below $100 (blue line) through expiration in 6 weeks:

Buy to Open the PM 1 Sep 103 call (PM230901C103)

Sell to Open the PM 1 Sep 100 call (PM230901C100) for a credit of $0.65 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $97.52 close. Unless PM falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $63.70. This trade reduces your buying power by $300, making your net investment $236.30 per spread ($300 – $63.70). If PM closes below $100 on Sep. 1, the options will expire worthless and your return on the spread would be 27% ($63.70/$236.30).

**The second half started out well for Insider members, as our four portfolios have combined to return subscribers more than 20% for 2023. And our QQQ portfolio is leading the way, up over 70%. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Watch Out Below

Watch Out Below

Five Below (FIVE) is a “specialty value retailer,” which means (I think, since I’ve never been in one) that it sells a lot of stuff on the cheap. The company reported earnings last week that were more miss than hit. Earnings were the lone bright spot, as FIVE beat the consensus EPS estimate. Sales were higher from a year earlier but fell just short of analyst expectations. Comparable sales were higher by 2.7%, but that was considerably less than the 3.2% forecast. Perhaps most important, FIVE’s sales and earnings projections for next quarter came in below analyst estimates.

The reaction to FIVE’s numbers was mixed. There were several “maintains” ratings, meaning nobody wanted to rock the boat. Price targets were tweaked both up and down, with a couple of firms adjusting by a mere buck or two, which amounted to less than 1% of the target. Analysts overall are bullish on the shares, giving it a consensus buy rating. The average target price is in the $215-220 range, which is around 17% above Friday’s close.

This bullishness was warranted going back to last year. From early July through mid-April, FIVE was on fire, doubling in value. It actually outperformed NVIDIA (NVDA) during that period. But for the past two months, it’s been a different story. The stock is down 16%. The 50-day moving average has rolled over into a decline for the first time since last July. A post-earnings rally of 15% was rejected at the 50-day after just three days. Note that the short strike of our call spread sits a point above the 50-day. However, the downtrend should pull the trendline below this strike within the next week, setting up a point of resistance that should keep the short strike out of the money.

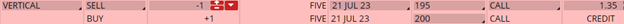

If you agree that FIVE will continue to struggle under the weight of its 50-day moving average (blue line), consider the following credit spread trade that relies on the stock staying below 195 (red line) through expiration in 6 weeks:

Buy to Open the FIVE 21 Jul 200 call (FIVE230721C200)

Sell to Open the FIVE 21 Jul 195 call (FIVE230721C195) for a credit of $1.30 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $185.20 close. Unless FIVE drops sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $128.70. This trade reduces your buying power by $500, making your net investment $371.30 per spread ($500 – $128.70). If FIVE closes below 195 on July 21, both options will expire worthless and your return on the spread would be 35% ($128.70/$371.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – A Gnawing Feeling

A Gnawing Feeling

With earnings season winding down, there are few post-earnings plays to consider. But the cupboard isn’t completely bare. After a couple of bullish trades, we’re going the other way with a bearish play on pet food provider Chewy (CHWY), which reported earnings after the bell on Wednesday. The company easily beat forecasts on earnings and topped revenue expectations. Moreover, CHWY announced it would expand into Canada in 3Q, its first foray outside the U.S. The stock soared on the news, spiking as high as 27% the next day before closing 22% higher.

So why the bearish trade? The number of active customers declined for the second quarter in a row, leading some analysts to question CHWY’s ability to maintain strong sales growth. In addition, competitors have noted lower selling prices and customers trading down to cheaper brands. Analysts had a lukewarm reaction to the earnings blowout, with a few small target price increases. That pushed the average price 27% above Friday’s close, which seems excessive for a stock that’s down 33% from an early-February high.

The stock was unable to follow through on Thursday’s surge, falling back on Friday when the market soared. Sitting overhead is the declining 200-day moving average at 38, a trendline the stock last closed above more than two months ago. With earnings – and the huge pop – now out of the way, we are betting on the stock struggling to overtake the 200-day, which is where the short call strike of our spread resides.

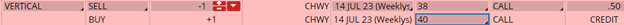

If you agree that CHWY will continue to trade under the weight of its 200-day moving average (blue line), consider the following credit spread trade that relies on the stock staying below 38 (red line) through expiration in 6 weeks:

Buy to Open the CHWY 14 Jul 40 call (CHWY230714C40)

Sell to Open the CHWY 14 Jul 38 call (CHWY230714C38) for a credit of $0.47 (selling a vertical)

This credit is $0.03 less than the mid-point price of the spread at Friday’s $35.51 close. Unless CHWY drops sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $45.70. This trade reduces your buying power by $200, making your net investment $154.30 per spread ($200 – $45.70). If CHWY closes below 38 on July 14, both options will expire worthless and your return on the spread would be 30% ($45.70/$154.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Losing Power

May 1, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This is a post-earnings stock trade on a utility that closed flat today, so you can enter the position at the same price as my Insiders. Good luck with the trade!

But first, how about our Honey Badger portfolio?! Trading only QQQ options, it’s on fire, up a whopping 30% for 2023. Of course, don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t miss out on the profits. For our loyal (thanks for that, by the way) newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Losing Power

NextEra Energy (NEE) is an electricity generator and provider operating in southern Florida. You may know it by its principal subsidiary – Florida Power & Light, the largest electric utility in the U.S. NEE reported earnings this week that seemed strong. The company swung to a profit and easily beat both earnings and revenue estimates. It added 65,000 customers, as everyone is moving to Florida. It reiterated its earnings projections for 2023 and it plans to boost dividends by 10% per year through next year.

What’s not to like?

Well, analysts apparently were not energized, as the shares were hit with a downgrade and a few target price cuts (there was one target increase). Despite the sour reaction, the stock has an overall outperform rating and average target price 23% above Friday’s close. In fact, the target sits just above NEE’s all-time high, which seems a bit overinflated. This tells me that there is more than ample room for further downgrades and target cuts.

The stock price followed the analysts’ lead by dropping 6.3% in the two days following earnings. That pulled the shares below the 20-day moving average, a trendline that had guided NEE higher during the previous month. The stock also fell below the 50-day moving average but recovered later in the week. That said, NEE closed the week 3% below its pre-earnings price.

The most daunting technical obstacle, however, is the flat 200-day moving average, sitting between the 80 and 81 levels. This trendline has served as both support and resistance and now appears ready to keep the shares below the 80 level. I’ll note that the stock hit a two-month high a point below the 200-day a week ago. This trade is based on this resistance holding as NEE struggles with the post-earnings blues.

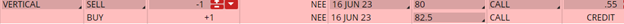

If you agree that NEE will fail to overtake its 200-day moving average (blue line) for the next few weeks, consider the following trade that relies on the stock staying below $80 (red line) through expiration in 7 weeks:

Buy to Open the NEE 16 Jun 82.5 call (NEE230616C82.5)

Sell to Open the NEE 16 Jun 80 call (NEE230616C80) for a credit of $0.50 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $76.63 close. Unless NEE sags at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $250, making your net investment $201.30 per spread ($250 – $48.70). If NEE closes below $80 on June 16, both options will expire worthless and your return on the spread would be 24% ($48.70/$201.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for the very smart yet understandable way to trade options? Look no further.

~ Phil Wells

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Stuck in Neutral

April 18, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. This stock hasn’t done much this week, so you can enter this trade at about the same price as my Insiders. Good luck with the trade!

But first, it’s time for my usual pitch for our premium Terry’s Tips service. We’re solidly in the black this year, led by our Honey Badger portfolio (it trades QQQ options), which is up an impressive 23%. Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Stuck in Neutral

Used-car retailer CarMax (KMX) is a stock that attracts a wide range of opinions. This week, KMX reported earnings that had something for both bulls and bears. On the bullish side, earnings per share (EPS) more than doubled the consensus estimate. But the bears will point out that net income fell 57% from a year earlier. Revenue declined 25% and fell far short of expectations. And the company pointed out that “headwinds remained due to widespread inflationary pressures, climbing interest rates, tightening lending standards, and prolonged low consumer confidence.” Even so, KMX affirmed its long-term financial targets.

Analysts were all over the road with their reactions. Some pointed to the success of KMX’s cost management strategy. Others reiterated the headwinds the company itself discussed. If there is a consensus, it appears that the short to neutral term will be challenging, while the longer-term outlook is encouraging.

KMX’s chart also has some headwinds in the form of the 200-day moving average. The stock hasn’t closed a day above this declining trendline since December 2021. Rally attempts in August and February were stopped in their tracks by the 200-day. And so was the post-earnings pop this week.

This trade is a bet that the short-term road will be bumpy for KMX and that the 200-day will continue to keep the stock in a six-month trading range bounded on the upside by the 75 level. This is also where the 200-day currently resides.

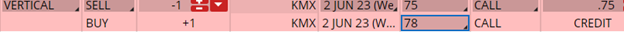

If you agree that KMX will struggle under the weight of its 200-day moving average (blue line) for the next few weeks, consider the following trade that relies on the stock staying below $75 (red line) through expiration in 7 weeks:

Buy to Open the KMX 2 Jun 78 call (KMX230602C78)

Sell to Open the KMX 2 Jun 75 call (KMX230602C75) for a credit of $0.70 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $69.46 close. Unless KMX plunges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $68.70. This trade reduces your buying power by $300, making your net investment $231.30 per spread ($300 – $68.70). If KMX closes below $75 on June 2, both options will expire worthless and your return on the spread would be 30% ($683.70/$231.30).

Testimonial of the Week

Thanks so much for detail explanation of each trade. I simply love your report and eagerly waiting for your report every Saturday. I am glad I found you guys. I am super happy to learn how your make a trade and invest with so much dedication, active management and vast array of knowledge, otherwise it’s simply not possible to see such wonderful returns.

~ Senjeev

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – In Need of Restoration

April 3, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. After three straight put spreads, it was time for a bearish post-earnings play, this time on a higher-end retailer. Good luck with the trade!

But first, it’s time for my usual pitch for our premium Terry’s Tips service. Though our portfolios slipped slightly last week (hey, it happens), we still had a solid first quarter. And our Honey Badger portfolio (it trades QQQ options) was up an impressive 22%. Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

In Need of Restoration

We’ve had three straight bullish plays in this space (all doing well), so it’s time to put one on the bearish side of the ledger. Even though earnings reports slowed to a trickle, we found one that fit the bill.

High-end home furnishings retailer RH (RH), formerly known as Restoration Hardware (an odd name that was deservedly dumped in 2017), reported earnings after the bell on Wednesday. It was one of the few companies this quarter that missed on all counts – earnings, revenue and guidance. And these weren’t small misses. Earnings per share, for example, came in at $2.88 compared to the $3.32 expected by analysts. The sales forecast for next quarter is $720-735 million, while the Street is expecting $827 million. To top it off, RH’s CEO said the next several quarters would be challenging, citing housing weakness and bank failures. Not a good outlook.

Analysts couldn’t get their price target cuts out the door fast enough. One lowered it from $280 to $225, well below Friday’s close. In fact, several lowered their targets below the current share price. Even with the cuts, the average target is 13% above the stock price and the average analyst rating is a moderate buy. This suggests that more target cuts and perhaps a few downgrades would be deserved for a stock that is down 9% this year and 67% from its all-time high hit in August 2021.

RH’s chart is filled with all sorts of bearish indicators. The 20-day moving average has been plunging since mid-February and bearishly crossed below the 50-day, which itself has rolled over into a decline. The 20-day also crossed below the 200-day, which has been trending lower since January 2022. That’s why we’re going with a bearish call spread with the short strike sitting just above the 20-day. Note that the 20-day hasn’t allowed a single close above it since turning lower six weeks ago.

If you agree that RH will continue to languish below its 20-day moving average (blue line) after a disappointing earnings report and downbeat guidance, consider the following trade that relies on the stock staying below $255 (red line) through expiration in 6 weeks:

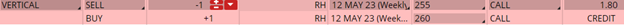

Buy to Open the RH 12 May 260 call (RH230512C260)

Sell to Open the RH 12 May 255 call (RH230512C255) for a credit of $1.75 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $243.55 close. Unless RH plunges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $173.70. This trade reduces your buying power by $500, making your net investment $326.30 per spread ($500 – $173.70). If RH closes below $255 on May 12, both options will expire worthless and your return on the spread would be 53% ($173.70/$326.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube