Watch Out Below

Five Below (FIVE) is a “specialty value retailer,” which means (I think, since I’ve never been in one) that it sells a lot of stuff on the cheap. The company reported earnings last week that were more miss than hit. Earnings were the lone bright spot, as FIVE beat the consensus EPS estimate. Sales were higher from a year earlier but fell just short of analyst expectations. Comparable sales were higher by 2.7%, but that was considerably less than the 3.2% forecast. Perhaps most important, FIVE’s sales and earnings projections for next quarter came in below analyst estimates.

The reaction to FIVE’s numbers was mixed. There were several “maintains” ratings, meaning nobody wanted to rock the boat. Price targets were tweaked both up and down, with a couple of firms adjusting by a mere buck or two, which amounted to less than 1% of the target. Analysts overall are bullish on the shares, giving it a consensus buy rating. The average target price is in the $215-220 range, which is around 17% above Friday’s close.

This bullishness was warranted going back to last year. From early July through mid-April, FIVE was on fire, doubling in value. It actually outperformed NVIDIA (NVDA) during that period. But for the past two months, it’s been a different story. The stock is down 16%. The 50-day moving average has rolled over into a decline for the first time since last July. A post-earnings rally of 15% was rejected at the 50-day after just three days. Note that the short strike of our call spread sits a point above the 50-day. However, the downtrend should pull the trendline below this strike within the next week, setting up a point of resistance that should keep the short strike out of the money.

If you agree that FIVE will continue to struggle under the weight of its 50-day moving average (blue line), consider the following credit spread trade that relies on the stock staying below 195 (red line) through expiration in 6 weeks:

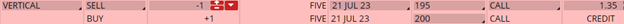

Buy to Open the FIVE 21 Jul 200 call (FIVE230721C200)

Sell to Open the FIVE 21 Jul 195 call (FIVE230721C195) for a credit of $1.30 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $185.20 close. Unless FIVE drops sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $128.70. This trade reduces your buying power by $500, making your net investment $371.30 per spread ($500 – $128.70). If FIVE closes below 195 on July 21, both options will expire worthless and your return on the spread would be 35% ($128.70/$371.30).

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube