February 22, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of their Saturday Report. I stayed on the bearish side this week but opted for an ETF rather than a post-earnings trade.

I’m doing something I rarely do with these trades for the free newsletter – I’m altering it because the trade has run away from the opening price. That is, it’s already up close to 20% in just two days. Because I still believe in the premise of the trade, I’m changing the strikes to give you a better chance for entry … and, of course, profit. Good luck with it.

Before getting to the trade, I wanted to let you know that the Terry’s Tips portfolios are on a hot streak. The combined four portfolios are now beating the S&P 500, led by the Boomer’s Revenge portfolio, which is up a whopping 23% so far this year! That’s on top of the 33% gain during last year’s horrible market performance. Overall, our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’ve decided to keep the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Low Energy

Although there were plenty of earnings reports this week, there weren’t many tradeable choices. By that I mean stocks with options that have decent bid/ask spreads. So, we’re taking a week off from post-earnings plays and going with a powerhouse ETF, the SPDR Utilities ETF (XLU). This market-cap-weighted, $15 billion fund holds utilities companies included in the S&P 500, including NextEra Energy (NEE), Duke Energy (DUK) and Southern Co. (SO).

XLU has underperformed in 2023, falling around 3% compared to the 6.5% increase in the S&P 500. The slide has been guided lower by the 20-day moving average, although the ETF closed slightly above this trendline last Friday. But the 20-day re-asserted itself this week to continue XLU’s slide.

XLU’s top 10 holdings have a similar story, as one would expect. The average return in 2023 is -2.4%, with eight of the 10 in the red. Seven are trading below their respective 50-day moving averages. And eight of the 10 50-day moving averages are declining or rolling over.

This trade is based on XLU continuing its downtrend over the next several weeks. The nearest level of support rests at the 64.50 level (3.6% below Wednesday’s close), the site of bottoms in February and June of last year. The declining 20-day moving average (blue line) remains in play as resistance, which is below the short call strike of our spread (red line), meaning the ETF will have to pierce this resistance to move the spread into the money.

If you agree that XLU will continue to struggle under the weight of moving-average resistance, consider the following trade that relies on the ETF staying below $68.50 through expiration in less than 6 weeks:

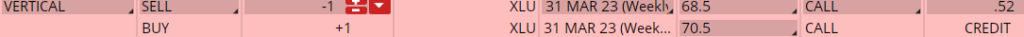

Buy to Open the XLU 31 Mar 70.5 call (XLU230331C70.5)

Sell to Open the XLU 31 Mar 68.5 call (XLU230331C68.5) for a credit of $0.50 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Wednesday’s $66.94 close. Unless XLU falls quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $48.70. This trade reduces your buying power by $200, making your net investment $151.30 per spread ($200 – $48.70). If XLU closes below $68.50 on Mar. 31, both options will expire worthless and your return on the spread would be 32% ($48.70/$151.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube