April 3, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. After three straight put spreads, it was time for a bearish post-earnings play, this time on a higher-end retailer. Good luck with the trade!

But first, it’s time for my usual pitch for our premium Terry’s Tips service. Though our portfolios slipped slightly last week (hey, it happens), we still had a solid first quarter. And our Honey Badger portfolio (it trades QQQ options) was up an impressive 22%. Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

In Need of Restoration

We’ve had three straight bullish plays in this space (all doing well), so it’s time to put one on the bearish side of the ledger. Even though earnings reports slowed to a trickle, we found one that fit the bill.

High-end home furnishings retailer RH (RH), formerly known as Restoration Hardware (an odd name that was deservedly dumped in 2017), reported earnings after the bell on Wednesday. It was one of the few companies this quarter that missed on all counts – earnings, revenue and guidance. And these weren’t small misses. Earnings per share, for example, came in at $2.88 compared to the $3.32 expected by analysts. The sales forecast for next quarter is $720-735 million, while the Street is expecting $827 million. To top it off, RH’s CEO said the next several quarters would be challenging, citing housing weakness and bank failures. Not a good outlook.

Analysts couldn’t get their price target cuts out the door fast enough. One lowered it from $280 to $225, well below Friday’s close. In fact, several lowered their targets below the current share price. Even with the cuts, the average target is 13% above the stock price and the average analyst rating is a moderate buy. This suggests that more target cuts and perhaps a few downgrades would be deserved for a stock that is down 9% this year and 67% from its all-time high hit in August 2021.

RH’s chart is filled with all sorts of bearish indicators. The 20-day moving average has been plunging since mid-February and bearishly crossed below the 50-day, which itself has rolled over into a decline. The 20-day also crossed below the 200-day, which has been trending lower since January 2022. That’s why we’re going with a bearish call spread with the short strike sitting just above the 20-day. Note that the 20-day hasn’t allowed a single close above it since turning lower six weeks ago.

If you agree that RH will continue to languish below its 20-day moving average (blue line) after a disappointing earnings report and downbeat guidance, consider the following trade that relies on the stock staying below $255 (red line) through expiration in 6 weeks:

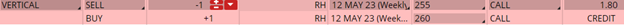

Buy to Open the RH 12 May 260 call (RH230512C260)

Sell to Open the RH 12 May 255 call (RH230512C255) for a credit of $1.75 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $243.55 close. Unless RH plunges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $173.70. This trade reduces your buying power by $500, making your net investment $326.30 per spread ($500 – $173.70). If RH closes below $255 on May 12, both options will expire worthless and your return on the spread would be 53% ($173.70/$326.30).

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube