March 27, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as included in this past weekend’s Saturday Report for our Terry’s Tips Insider Members. It was another post-earnings play, this time on a restaurant stock. Good luck with the trade!

Bright emotions, sweet victories and thrills await you after registering on the Pin Up casino website https://casinopinup.com.tr. This is a top licensed online gambling club with a large selection of slots, virtual roulette, live games, and sports betting is also available to customers. Pleasantly surprised by the varied bonus program with rewards for registration, account replenishment, loss, with regular free spins, tournaments and lotteries.

Terry’s Tips portfolios are on fire! The combined four portfolios had their best week in six weeks and have more than doubled the return of the S&P 500. The Honey Badger portfolio (it trades QQQ options) is up a whopping 24% so far this year! Don’t forget that our portfolios beat their underlying stock performance by an average of 22% in 2022.

Don’t get left behind. For our loyal newsletter subscribers, I’m keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Here’s The Beef

Darden Restaurants (DRI) – a sit-down restaurant chain conglomerate that includes Olive Garden, LongHorn Steakhouse and Capital Grille – reported earnings this week that beat on virtually every measure. Not only did the company top earnings and sales estimates, same-store sales growth also came in above expectations. And DRI upped guidance above the expected range. The company claimed that raising prices less than the rate of inflation drove higher sales.

Analysts cheered the news, though none upgraded the stock. Price target increases were plentiful, pushing the average to $159. But that’s hardly ebullient, as it sits just 4% above Friday’s closing price. That seems reasonable, however, unlike many so-called “growth” stocks.

The stock dropped less than half a percent after the report. Perhaps that’s because it rallied into earnings, a move that broke above a trading range that had contained the shares for much of this year. Despite the range, the stock has been in an overall uptrend since June, rising nearly 40%. The 50-day moving average has guided this rally, although here have been dips below it, the most recent coming earlier this month.

This trade is not necessarily a bet that DRI will continue rising. It’s more a defensive play that the stock will not suffer a serious decline and will remain above the 50-day (blue line) and the bottom of the recent trading range. We’re going a little further out of the money with the short put strike to add a measure of safety. That, of course, means the credit is less. Note that we are going out eight weeks, as DRI does not have weekly options.

If you agree that DRI will continue to trade in a range – or at least not weaken – consider the following trade that relies on the stock staying above $145 (red line) through expiration in 8 weeks:

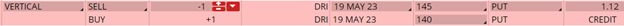

Buy to Open the DRI 19 May 140 put (DRI230519P140)

Sell to Open the DRI 19 May 145 put (DRI230519P145) for a credit of $1.10 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $152.58 close. Unless DRI surges, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $108.70. This trade reduces your buying power by $500, making your net investment $391.30 per spread ($500 – $108.70). If DRI closes above $145 on May 19, both options will expire worthless and your return on the spread would be 28% ($108.70/$391.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. – Maya

Any questions? Email Terry@terrystips.com.

Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube