February 8, 2023

Dear [[firstname]],

Here is your Option Trade of the Week, as given to our Terry’s Tips Insider Members as part of the Saturday Report. Being in the heart of earnings season, we again had several solid opportunities to choose from this week. We’re going scientific this week with another bullish play.

Before getting to the trade, I want you to know that we are extending our huge discount offer to join Terry’s Tips as an Insider Member that lets you trade up to four portfolios. These portfolios use our proprietary 10K Strategy, which has generated average annual gains of 60% for the past five years in actual brokerage accounts (including all commissions). In 2022, our portfolios beat their underlying stock performance by an average of 22%.

We’re still running a special new-year sale that saves you more than 50% on a monthly subscription to Terry’s Tips. For just $98, you’ll get:

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, still keep all the valuable reports.

We look forward to having you join us! Now on to the trade …

Going With The Science

Thermo Fisher Scientific (TMO) provides analytical instruments, diagnostics and lab products for life sciences research. Before the bell on Wednesday, the company reported earnings that easily beat estimates on both revenue and earnings per share (EPS). However, EPS fell from a year earlier, while operating margins contracted.

Analysts were apparently impressed by the report, as the stock was hit with a wave of target price increases. There were no rating upgrades, though perhaps that’s because analysts are already bullish on the stock.

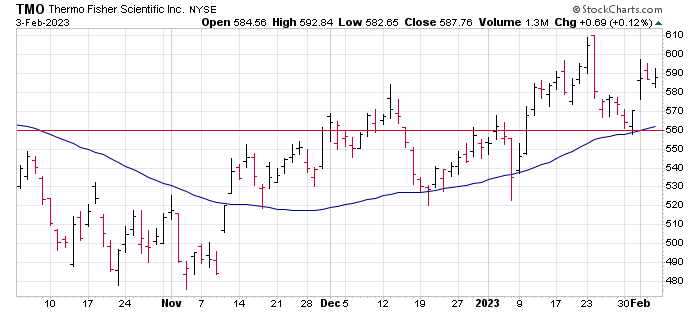

The stock reacted by moving 3% higher on Wednesday. That may not sound like much, but TMO has a history of subdued moves after earnings. In fact, it was the second-largest one-day move since April 2021. More importantly, though, is the fact that the shares bounced off their 50-day moving average to continue a rally that has seen TMO gain 23% off a Nov. 2 low. Moreover, the stock is now sitting above its 20-day moving average.

The 50-day moving average is the key to this trade, as the stock has closed below this trendline just once since crossing above it in mid-November. We’re counting on this support, as the short strike of our put spread sits just below the 50-day.

If you agree that TMO will continue to rally along the support of its 50-day moving average (blue line), consider the following trade that relies on the stock staying above $560 (red line) through expiration in 6 weeks:

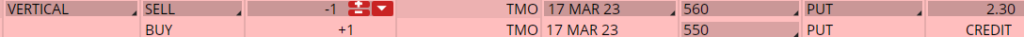

Buy to Open the TMO 17 Mar 550 put (TMO230317P550)

Sell to Open the TMO 17 Mar 560 put (TMO230317P560) for a credit of $2.25 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $587.76 close. Unless TMO rises quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $223.70. This trade reduces your buying power by $1,000, making your net investment $776.30 per spread ($1,000 – $223.70). If TMO closes above $560 on Mar. 17, both options will expire worthless and your return on the spread would be 29% ($223.70/$776.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. – Maya

Any questions? Email Terry@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube