Category Archives: Uncategorized

May 2, 2025 Terry’s Tips Trade Alert #2 – Honey Badger Portfolio

May 2, 2025 Terry’s Tips Trade Alert #2 – Honey Badger Portfolio

We are closing the final spread:

BTC 1 QQQ 02May25 487 call (QQQ250502C487)

STC 1 QQQ 30May25 475 call (QQQ250530C475) for a credit of $20.40 (selling a diagonal)

Be prepared to change this (these) price limit(s) by $.05 or more in order to get an execution.

Happy trading,

Jon

February 20, 2025 Terry’s Tips Trade Alert – Rising Tide Portfolio

January 23, 2025 Terry’s Tips Trade Alert – Boomer’s Revenge Portfolio

January 21, 2025 Terry’s Tips Trade Alert – Boomer’s Revenge Portfolio

We are closing spreads:

BTC 1 IWM 24Jan25 226 put (IWM250124P226)

STC 1 IWM 21Mar25 230 put (IWM250321P230) for a credit of $7.15 (selling a diagonal)

BTC 1 IWM 24Jan25 228 call (IWM250124C228)

STC 1 IWM 21Mar25 215 call (IWM250321C215) for a credit of $15.05 (selling a diagonal)

BTC 1 IWM 24Jan25 230 call (IWM250124C230)

STC 1 IWM 21Mar25 220 call (IWM250321C220) for a credit of $11.70 (selling a diagonal)

Be prepared to change this (these) price limit(s) by $.05 or more to get an execution.

Happy trading,

Jon

November 8, 2024 Terry’s Tips Trade Alert #3 – Rising Tide Portfolio

November 8, 2024 Terry’s Tips Trade Alert #3 – Rising Tide Portfolio

We continue chasing delta higher:

BTC 1 COST 15Nov24 905 put (COST 241115P905)

STC 1 COST 20Dec24 905 put (COST 241220P905) for a credit of $13.20 (selling a calendar) (100%)

BTC 1 COST 15Nov24 935 call (COST 241115C935)

STO 1 COST 15Nov24 960 call (COST 241115C960) for a debit of $12.15 (buying a vertical) (100%)

Be prepared to change this (these) price limit(s) by $.05 or more in order to get an execution.

Happy trading.

Jon

June 5, 2024 Terry’s Tips Trade Alert – Wiley Wolf Portfolio

June 5, 2024 Terry’s Tips Trade Alert – Wiley Wolf Portfolio

We are closing put spreads to increase delta:

BTC 1 MSFT 21Jun24 402.5 put (MSFT240621P402.5)

STC 1 MSFT 19Jul24 435 put (MSFT240719P435) for a credit of $15.35 (selling a diagonal) (100%)

BTC 1 MSFT 21Jun24 405 put (MSFT240621P405)

STC 1 MSFT 19Jul24 430 put (MSFT240719P430) for a credit of $11.90 (selling a diagonal) (100%)

Be prepared to change this (these) price limit(s) by $.05 or more in order to get an execution.

Happy trading.

Jon

May 31, 2024 Terry’s Tips Trade Alert #3 – Rising Tide Portfolio

May 31, 2024 Terry’s Tips Trade Alert #3 – Rising Tide Portfolio

This completes rolling out and adds two call spreads:

BTC 1 COST 31May24 795 put (COST 240531P795)

STO 1 COST 21Jun24 800 put (COST 240621P800) for a credit of $13.45 (selling a diagonal) (100%)

BTO 1 COST 19Jul24 830 call (COST 240719C830)

STO 1 COST 21Jun24 830 call (COST 240621C830) for a debit of $7.00 (buying a calendar)

BTO 1 COST 19Jul24 810 call (COST 240719C810)

STO 1 COST 21Jun24 810 call (COST 240621C810) for a debit of $8.70 (buying a calendar)

Be prepared to change this (these) price limit(s) by $.05 or more in order to get an execution.

Happy trading.

Jon

March 21, 2023 Terry’s Tips Trade Alert – Honey Badger Portfolio

March 21, 2023 Terry’s Tips Trade Alert – Honey Badger Portfolio

We are adding a spread to raise delta:

BTO 1 QQQ 19May23 310 call (QQQ230519C310)

STO 1 QQQ 31Mar23 319 call (QQQ230331C319) for a debit of $11.45 (buying a diagonal)

Be prepared to change this (these) price limit(s) by $.05 or more in order to get an execution.

Happy trading.

Jon

Watch for the Bear Trap

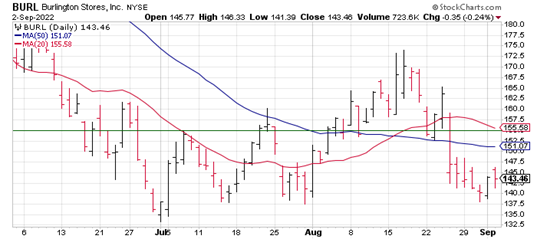

Zurich-based Chubb Limited (CB) is the world’s largest publicly traded property and casualty insurance company. CB reported earnings this week that topped estimates. But the market wasn’t sure how to react, as analysts offered a mix of target price increases and decreases. What’s clear, however, is that analysts are overwhelmingly bullish toward CB, as 84% give the stock a buy or better rating. Perhaps this is due to the “conventional” wisdom that insurance companies benefit from rising interest rates.

But analysts would be well advised to check out CB’s chart. Despite the solid earnings numbers, the stock ended the week flat. Moreover, it failed to break out of a four-month downtrend that has seen the stock drop 14%. This slide has been guided by the 20-day moving average (blue line in chart), which hasn’t allowed a daily close above it since early June. Above that lies the 50-day moving average (red line), which has yet to be tested. It sits at the $196 level, just a point above the short strike of our call credit spread. At its current slope, it will fall below this strike in the coming week. Thus, the stock will have to pierce two points of resistance to move into the money.

If you agree that the 20-day moving average will continue guiding CB lower, consider the following trade that relies on the stock staying below $195 (green line) through expiration in seven weeks:

Buy to Open the CB 16Sep 200 call (CB220916C200)

Sell to Open the CB 16Sep 195 call (CB220916C195) for a credit of $1.40 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $188.64 close. Unless CB drops quickly, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $138.70. This trade reduces your buying power by $500, making your net investment $361.30 per spread ($500 – $138.70). If CB closes below $195 on September 16, both options will expire worthless and your return on the spread would be 38% ($138.70/$361.30).

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube