Category Archives: terrystips

Option Trade of the Week – Fool Me Once … (VEEV)

April 1, 2024

Fool Me Once …

There was nothing on the weekly earnings docket that I considered trade worthy. Even the few names I recognized were either too low-priced, had lousy options or bid/ask spreads, or, most importantly, not giving me a good chart read. During slow earnings periods – which include next week and most of the following week – I look back at past trades to see how they look today. One that I like just happens to be the last trade we closed for a loss. But I whiffed so badly on it – I suggested a bearish trade and the stock cruised 20% higher – that I now like it as a bullish play.

The stock is Veeva Systems (VEEV), which provides cloud-based software for the health sciences industry. VEEV reported solid earnings results in late February, beating estimates on revenue and earnings per share. Guidance for the first quarter came up short on revenue, which may be why the stock stumbled a bit after the report.

Analysts were very clear in their view toward VEEV, handing the stock a boatload of target price increases. Maybe they’re trying to play catch-up because the current average target price – after all the increases – is right around Thursday’s closing price. Given that VEEV is a tech stock (though it’s considered in the healthcare sector), that’s an underwhelming endorsement for a stock that’s rallied 40% in less than four months. It’s not hard to see how more target price increases and perhaps a ratings change or two (the current average rating is a buy) could be in the offing.

There aren’t many charts prettier than VEEV’s daily chart. The stock has climbed steadily since an early December low, riding along the solid support of its 20-day moving average. How solid? The trendline has been tested no less than a half-dozen times and has allowed just one daily close below it. This trade is based on the uptrend and support continuing for the next several weeks, perhaps aided by some analyst love.

The 20-day moving average sits just below the 230 level, while the 50-day is at 220. VEEV offers only monthly options, with strikes every 10 points within the range we want. Therefore, I am forced to go with the May series and the 220 short strike. This is producing a little less credit – and thus return – compared to our usual trades. But that means the short strike is further out of the money (less risky).

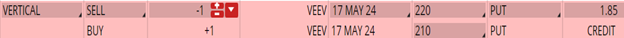

If you agree that the stock will continue to trade above its 20-day (blue line) moving average, consider the following credit spread trade that relies on VEEV staying above $220 (red line) through expiration in 7 weeks:

Buy to Open the VEEV 17 May 210 put (VEEV240517P210)

Sell to Open the VEEV 17 May 220 put (VEEV240517P220) for a credit of $1.80 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $231.69 close. Unless VEEV surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $178.70. This trade reduces your buying power by $1,000, making your net investment $821.30 per spread ($1,000 – $178.70). If VEEV closes above $220 on May 17, the options will expire worthless and your return on the spread would be 22% ($178.70/$821.30).

** We are crushing it! Our Costco (COST) portfolio was up 30% in the first quarter. Our Microsoft (MSFT) portfolio gained 15% (last year this portfolio returned more than 70%). And our IWM portfolio added nearly 20%. All in just one quarter.

Don’t be left behind … there’s still time to save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Free Option Trade of the Week – Sunny Outlook (FSLR)

March 5, 2024

Sunny Outlook

We’re headed back to the bullish side this week with a trade on First Solar (FSLR). The country’s largest solar module maker reported earnings on Tuesday after the bell. Earnings per share came in above estimates, while revenue fell short despite growing more than 15% year over year. The company guided earnings and sales that were in line with or slightly higher than the analyst consensus.

The stock jumped as much as 9% on the news before closing 3% higher. That’s in sharp contrast to other solar companies, which have been plagued by lower demand, high interest rates, regulatory changes and higher inventories. But FSLR managed to overcome those headwinds with stronger pricing power, something analysts see continuing in 2024.

The news was not met with any ratings changes, though there were a few target price increases. Depending on the source, FSLR’s average target price is in the $210-235 range, which is well above Friday’s $158 close. Given that the stock reached a high of $232 last May – its highest level in the past 25 years – these estimates may be a tad overexuberant.

My take on FSLR – based on the charts – is more conservative. The stock has gone nowhere in the past five months, travelling mostly between the 140 and 175 levels. The 20-day and 50-day moving averages, which have provided nothing in terms of support or resistance, are horizontal and of little use.

Given the positive earnings results and outlook, we’re looking for the bottom of this trading range continuing to hold at 140, a level the stock has closed below just seven times going back to October 2022. The short strike of our put spread is at 140, which is more than 11% below Friday’s close. Because we’re going so far OTM with this trade, the credit and max return are somewhat lower than most of our trades. Less risk, less reward.

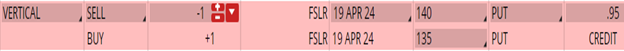

If you agree that the stock will continue respecting the bottom of its trading range, consider the following credit spread trade that relies on FSLR staying above $140 (blue line) through expiration in 7 weeks:

Buy to Open the FSLR 19 Apr 135 put (FSLR240419P135)

Sell to Open the FSLR 19 Apr 140 put (FSLR240419P140) for a credit of $0.90 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $158.05 close. Unless FSLR surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $88.70. This trade reduces your buying power by $500, making your net investment $411.30 per spread ($500 – $88.70). If FSLR closes above $140 on Apr. 19, the options will expire worthless and your return on the spread would be 22% ($88.70/$411.30).

** We are crushing it! Our Costco (COST) portfolio is up 23% already this year. Our Microsoft (MSFT) portfolio is up 14% (last year this portfolio returned more than 70%). Don’t be left behind … there’s still time to save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – It’s Intuitive

January 31, 2024

Dear [[firstname]],

Here’s your Option Trade of the Week as included in this past weekend’s Saturday Report for our Terry’s Tips Premium Members.The credit from last week’s trade ran away from us pretty quickly, so I opted to pass on sending it out knowing that you wouldn’t get the minimum credit. This week’s trade – which gets us back on a bullish track – has a better chance for entry. So, I’m hoping that you can make it work.

Before that, though, I have to tell you that our Microsoft (MSFT) portfolio – we call it Wiley Wolf – is on fire. With January in the books, we are already up more than 22% while the stock itself is up less than 6%. In fact, we booked more than half that huge gain just today after MSFT’s earnings!

How did we do it? The same way we bagged 70% and 92% profits using MSFT and QQQ last year – Dr. Terry Allen’s 10K Strategy. This market-beating strategy has proven itself over the past two decades … and this year looks to be no exception.

You can’t afford to miss out on these profits. Resolve to make 2024 your best trading year ever – and learn about Terry’s unique strategy – by becoming a Premium Member of Terry’s Tips.

For our loyal newsletter subscribers (that’s you), I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips. Plus, I’m adding a promise that this rate will never increase. I won’t make this promise forever, though, so now is the time to get in on the action … and profits.

As a Premium Member to Terry’s Tips, you’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions. Trade one portfolio (I recommend Wiley Wolf) or all four. It’s up to you.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- Access to our autobrokers to make trades on your behalf.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

- Annual subscription available for more than 50% savings

And, for a limited time, I am including a Special Bonus. Terry Allen has condensed his 30 years of options trading experience into an eBook – Making 36% – A Duffer’s Guide to Breaking Par in the Market Every Year, in Good Years and Bad. Learn a different way to trade using Terry’s unique and decades-tested 10K Strategy. This book is normally $9.98 on our website (and $19.95 on Amazon), but I will personally send you the digital version for free with a paid subscription.

To become a Terry’s Tips Premium Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports and the book.

I look forward to having you join in the fun and profits! Now on to the trade …

It’s Intuitive

Lots to chew on this week with earnings season in full swing, so let’s dive right in with a bullish trade on Intuitive Surgical (ISRG). The company makes surgical instruments, notably the da Vinci robot, that emphasize minimal invasiveness. ISRG reported Tuesday after the bell, easily beating on the top (profit) and bottom (revenue) lines. Earnings per share increased 30% from a year earlier, while revenues improved more than 16%. Much of this growth came from a 21% increase in da Vinci procedures.

Analysts were quick to raise their target prices, with at least a half dozen trying to beat each other to the punch. These were not minor increases, either. One firm raised its target by 35%, while several others were around 15%. That equates to increases of $30 to more than $100 … not bad for a $375 stock. Oddly, there were no rating increases, keeping ISRG at a solid buy rating. However, there are few holds on the stock, leaving some room for upgrades.

Also odd is the fact that the stock fell as much as 3.4% on Wednesday, though it closed just 0.4% lower. That’s the smallest move after earnings in more than 11 years. There wasn’t much action after that, as ISRG gained about a percent on Thursday and Friday. The stock reaction might give one pause given the strong earnings results. However, the muted move makes more sense since the company already released bullish guidance numbers a couple of weeks ago. That caused the shares to pop more than 10%, making this week’s news less impactful.

The guidance surge pulled the stock away from its 20-day moving average, a trendline that has guided a 47% rally over the past three months. The shares spent a few days just below the 20-day in early January, the only time they were staring up at the trendline since crossing above it on November 1. We are therefore using the 20-day as the basis of this week’s bullish trade. The short put strike of our spread sits just below the 20-day, which is about 6% beneath Friday’s close.

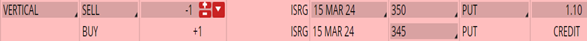

If you agree that the stock will continue trading above, or at least near, the 20-day moving average (blue line), consider the following credit spread trade that relies on ISRG staying above $350 (red line) through expiration in 7 weeks:

Buy to Open the ISRG 15 Mar 345 put (ISRG240315P345)

Sell to Open the ISRG 15 Mar 350 put (ISRG240315P350) for a credit of $1.00 (selling a vertical)

This credit is $0.10 less than the mid-point price of the spread at Friday’s $374.76 close. Unless ISRG surges sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $98.70. This trade reduces your buying power by $500, making your net investment $401.30 per spread ($500 – $98.70). If ISRG closes above $350 on Mar 15, the options will expire worthless and your return on the spread would be 25% ($98.70/$401.30).

Testimonial

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for very smart yet understandable way to trade options? Look no further. ~ Phil Wells

Remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. And get Terry’s eBook for free.

Any questions? Email Jon@terrystips.com. Thank you again for being a part of the

Terry’s Tips newsletter.

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – United We Fall

January 17, 2024

Dear [[firstname]],

It may be a little late, but Happy New Year! I haven’t sent an issue for a while because the credits for our weekly trades weren’t close enough to my target entry prices. As you know, I will not send an issue with a trade you have no chance of entering. This week, however, the credit is higher than when I sent the trade to our premium subscribers, meaning your maximum profit is now greater.

This is my first chance to tell you about the amazing profits we racked up last year. Our QQQ portfolio gained more than 90% for the year, while our MSFT portfolio brought in 70%. We’re on some kind of roll with MSFT, averaging gains of more than 100% over the past 5 years. And 2024 has started the same way … in the profit column.

You can’t afford to miss out on these profits. Resolve to make 2024 your best trading year ever with a subscription to Terry’s Tips.

For our loyal newsletter subscribers (that’s you), I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips. Plus, I’m adding a promise that this rate will never increase. I won’t make this promise forever, though, so now is the time to get in on the action … and profits.

As a Premium Member to Terry’s Tips, you’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions. Trade one portfolio or all four. It’s up to you.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

And for a limited time, I am including a Special Bonus. Terry Allen has condensed his 30 years of options trading experience into an eBook – Making 36% – A Duffer’s Guide to Breaking Par in the Market Every Year, in Good Years and Bad.” Learn a different way to trade using Terry’s unique and decades-tested 10K Strategy. This book is normally $9.98 on our website (and $19.95 on Amazon), but I will personally send you the digital version for free with a paid subscription.

To become a Terry’s Tips Premium Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports and the book.

I look forward to having you join in the fun and profits! Now on to the trade …

United We Fall

Earnings season started this week, though the number of reports was limited. Big banks dominated the headlines, but I didn’t see anything tradeable there. And I was looking for a bearish play to diversify a portfolio that will be all put spreads after this coming Friday.

So, I went with a company that’s bigger – by market cap – than any bank: UnitedHealth Group (UNH). The company reported on Friday, beating expectations for both revenue and income. But a key metric – the medical cost ratio – came in well above estimates. And that proved to be UNH’s undoing, as the stock slumped 3.4% on Friday.

UNH has a half-trillion-dollar market cap, so it gets a lot of analyst coverage. But oddly, there wasn’t a peep from the analyst community on Friday – no ratings changes and no target price moves. Perhaps they were mulling over their overly bullish stance toward the stock.

According to Yahoo! Finance, all 22 rating analysts consider UNH a buy or strong buy. The average target price is around $600, which is 15% above Friday’s close and 7% above the stock’s all-time high, set in October 2022. And it’s not like UNH set the world on fire in 2023. In fact, the stock closed the year a few bucks lower. Maybe we’ll start seeing some analysts ease back on the throttle and temper their targets and ratings, which could put some pressure on the stock.

The price drop on Friday pulled the shares below both their 20-day and 50-day moving averages. For the technical purists, the 20-day (blue line) bearishly crossed below the 50-day (red line) at the end of last year.

I’ve also noted an interesting pattern with UNH. Whatever the stock does the day after earnings tends to be the path for the next several weeks. After the past two earnings reports, the stock gained after earnings and continued to be higher through the subsequent five weeks. The two quarters before that, it was the opposite story – lower the day after earnings and five weeks after earnings. So, if history holds, UNH may find some rough sledding for the next few weeks. Plus, it will have to overcome its short-term moving averages, which are both headed lower.

This week’s bearish call spread has a short strike at the 540 level, which is above both the 20-day and 50-day moving averages. It also sits in an area where the stock has struggled to consistently stay above. Note that this is a 10-point spread because that is the strike increment in the 16Feb series. We’re going with the monthly series because UNH’s weekly options have poorer liquidity. Thus, these spreads will require more buying power, as noted below.

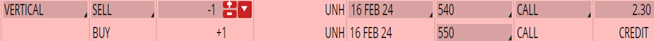

If you agree that the stock will continue to struggle after its earnings slump, consider the following credit spread trade that relies on UNH staying below $540 (green line) through expiration in 5 weeks:

Buy to Open the UNH 16 Feb 550 call (UNH240216C550)

Sell to Open the UNH 16 Feb 540 call (UNH240216C540)

for a credit of $2.20 (selling a vertical)

This credit is $0.10 less than the mid-point price of the spread at Friday’s $521.51 close. Unless UNH falls sharply at the open on Tuesday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $218.70. This trade reduces your buying power by $1,000, making your net investment $781.30 per spread ($1,000 – $218.70). If UNH closes below $540 on Feb 16, the options will expire worthless and your return on the spread would be 8% ($218.70/$781.30).

Testimonial of the Week

I have been a subscriber for about a year. I autotrade in 2 different accounts, all your strategies. I read everything you write on Saturdays. I love your happiness thoughts and everything else. I usually do not communicate at all but I had to tell you how well my accounts with you are doing compared to everything else. You are awesome. Keep up the good work. Thank you. – Maya

Remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. And get Terry’s eBook for free.

Any questions? Email Jon@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon L

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Cloudy Outlook

December 13, 2023

Dear [[firstname]],

I haven’t written for a while because the credits weren’t close enough to my target entry prices. This week, however, the credit is higher than when I sent the trade to our premium subscribers, meaning your maximum profit is now greater.

Before I get to the trade, I want to let you know that we’re winding up another solid year for our Terry’s Tips portfolios. Our QQQ portfolio is up more than 70% for the year, while our MSFT portfolio is up more than 55%.

You can’t afford to miss out on these profits in 2024. Treat yourself to an early holiday gift with a subscription to Terry’s Tips. For our loyal newsletter subscribers (that’s you), I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips.

You’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions. Trade one portfolio or all four. It’s up to you.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

To become a Terry’s Tips Insider Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports.

I look forward to having you join in the fun and profits! Now on to the trade …

Cloudy Outlook

Sorry for the lousy title. I couldn’t come up with anything clever for today’s stock, which, quite frankly, I’ve never heard of. That’s OK, though, because I know little to nothing about cloud-based software for the health sciences, which is what Veeva Systems (VEEV) provides. I don’t really care about what a company does, or if I’ve ever heard of them. I do know that the stock has liquid options with ample open interest and reasonably narrow bid/ask spreads, which is a must for our trades.

I also know that VEEV reported earnings after the close on Wednesday. The company slightly beat both the profit and revenue forecasts but pulled back revenue guidance for the coming quarter. It’s worth noting that a month ago, VEEV plunged nearly 15% after lowering revenue guidance on lower-than-expected services sales.

The earnings news apparently spooked the market, which drove VEEV more than 7% lower on Thursday before the stock recovered to close down 3%. Analysts also were edgy, as evidenced by a few price target reductions (there was one increase). But the consensus target price remains more than 20% above Friday’s close, which seems overly optimistic. Analysts are also firmly in the “buy” camp for VEEV, which also seems misplaced for a stock that has underperformed the market this year.

On the charts, VEEV has made little progress after the November plunge. In fact, the shares are down 23% from their 2023 high hit in September. This slide has been efficiently guided by the 20-day moving average, which has allowed only a handful of closes above it since mid-October. The technical level I’m watching is 180, a point of staunch resistance the stock has failed to close above since the November plummet. That is also the sight of the short call strike of our credit spread. Note that the 20-day sits between 180 and the current stock price, adding another layer of resistance.

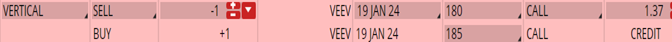

If you agree that the stock will continue to respect the monthlong resistance level and stick close to its 20-day moving average (blue line), consider the following credit spread trade that relies on VEEV staying below $180 (red line) through expiration in 6 weeks:

Buy to Open the VEEV 19 Jan 185 call (VEEV240119C185)

Sell to Open the VEEV 19 Jan 180 call (VEEV240119C180) for a credit of $1.25 (selling a vertical)

This credit is $0.12 less than the mid-point price of the spread at Friday’s $172.71 close. Unless VEEV falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $123.70. This trade reduces your buying power by $500, making your net investment $376.30 per spread ($500 – $123.70). If VEEV closes below $180 on Jan 19, the options will expire worthless and your return on the spread would be 33% ($123.70/$376.30).

Testimonial of the Week

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for very smart yet understandable way to trade options? Look no further. ~ Phil Wells

Remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.

Any questions? Email Jon@terrystips.com. Thank you again for being a part of the Terry’s Tips newsletter.

Happy trading,

Jon

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Two Option Trades of the Week – GE and SCHW

October 31, 2023

Avast Ye Schwabs

Two call spreads in Estee Lauder (EL) and the SPDR Healthcare ETF (XLV) expired worthless yesterday for gains of 25% apiece. To be fair, our bullish spread on Lululemon Athletica (LULU) expired in the money a week earlier for a larger loss. But the LULU misstep interrupted a string of seven straight winners. A large part of this success has been due to taking a more bearish stance toward the market. In fact, today’s trade marks the fifth straight bearish call spread and eighth of the past 11. And with good reason, as our only losses of the past two months have been bullish positions. We’re on a solid roll. I hope you’re banking some winners.

With earnings season hitting full stride this week, there’s no end to the trade possibilities. Of course, there were the spotlight names, such as Tesla (TSLA) and Netflix (NFLX), whose large post-earnings moves grabbed headlines. But I prefer stocks that have smaller, off-the-radar moves that have a lower likelihood of reversing. One such stock is Charles Schwab (SCHW), which is no stranger to these pages (you may recall I had a few issues with the TD transition in September).

SCHW reported before the open on Monday, so we had a whole week’s worth of post-earnings price action to digest. The numbers were mixed, with net income coming in slightly ahead of expectations while revenue fell a bit short. However, both numbers fell far short of last year’s figures. I won’t bore you by parsing through all the individual data points (bank deposits, net interest revenue, TD migration, new brokerage accounts, etc.). Analysts seem to feel that SCHW still faces several short-term hurdles that have buffeted it all year, though the longer-term prospects are encouraging.

Speaking of analysts, their reaction was much like SCHW’s earnings … mixed. There were no ratings changes while target price changes went both ways. But analysts are clearly bullish on SCHW, giving it a solid buy rating on average. The average target price is near $70, which is around 35% above Friday’s close. This fits into the struggle now, prosper later narrative I mentioned above. But since we’re looking ahead only a few weeks, the bearish case makes more sense.

On the chart, the stock reacted positively to earnings, popping 6% in Monday’s trading before settling for a 4.7% gain. But that was the high close of the week, as the shares tumbled more than 5% after Monday. It’s notable that the 20-day moving average provided staunch resistance throughout the week, containing the initial Monday burst and then sending the stock lower through the week’s end. The 20-day has done a solid job keeping the current decline intact since it rolled over in May. I’ll also note that the stock enjoyed a massive 12.6% spike after its previous earnings report in July, only to give it all back during the subsequent month.

If you agree that the stock will continue its downtrend based on the resistance from its 20-day moving average, consider the following credit spread trade that relies on SCHW staying below $53 through expiration in 6 weeks:

Buy to Open the SCHW 1 Dec 56 call (SCHW231201C56)

Sell to Open the SCHW 1 Dec 53 call (SCHW231201C53) for a credit of $0.75 (selling a vertical)

This credit is $0.09 less than the mid-point price of the spread at Friday’s $50.87 close. Note that I’m giving a little extra room on the entry credit. Unless SCHW falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $73.70. This trade reduces your buying power by $300, making your net investment $226.30 per spread ($300 – $73.70). If SCHW closes below $53 on Dec. 1, the options will expire worthless and your return on the spread would be 33% ($73.70/$226.30).

Low Voltage

We had another spread expire worthless on Friday, but it made us sweat. Adobe (ADBE) was looking great, which was saying something as our only open bullish position. It hit an annual high on Oct. 12, putting the short put nearly 15% out of the money. Then the falling market tide grabbed the stock and pulled it down to within eight points of the short strike at Friday’s close. Another day and it might have moved into the money. But it didn’t and we bagged a gain of over 30% for our eighth winner of the past nine closeouts. That leaves us with five open positions, all bearish call spreads.

I’d love to add a put spread this week, but I can’t make a case for fighting the bearish tape. Maybe next week. For this week, I had way too many earnings plays to choose from, as this was the busiest week of the season. Frankly, I stopped looking after an hour, realizing that I could have spent all day analyzing dozens and dozens of top names.

I settled on General Electric (GE), which may seem like an odd choice given that it had a blowout report and had its best post-earnings day in years. The company easily beat earnings and revenue estimates and raised earnings and revenue growth guidance for 2023. The stock responded with a 6.5% pop on Tuesday, its largest gain after earnings since Jan. 2020. What’s not to like, right?

Well, analysts didn’t seem overly excited. In fact, only two weighed in with target price increases of $1 and $2. That’s it. The average target sits near $126, which is around 19% above Friday’s close. I’ll also point out the last time GE saw $126 was six years ago. There were no ratings changes, which were already heavily slanted toward the buy level. This does not seem like a hearty endorsement of a stock that just had as good an earnings report as you’ll see.

While the shares enjoyed a big gain on Tuesday, the rest of the week didn’t go well. In fact, the stock closed out the week below the pre-earnings close. The dual resistance of the 20-day and 50-day moving averages were in play, as the stock closed the week below both. These trendlines have rolled over into declines, a bad sign given that the stock doesn’t stray far from either. Another factor to note: GE had a big pop of more than 6% after the previous earnings release, but the stock drifted lower after that first day and has never closed a day higher since.

It seems that the earnings effect lasted all of one day and the stock has resumed its downtrend that’s been in place for six weeks. This trade is a bet that the trend will continue, especially in light of the broader market’s weakness. Note that the short call strike sits above Tuesday’s close and the mid-October peak.

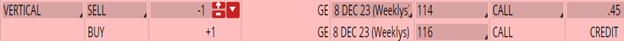

If you agree that the stock will continue its downtrend based on the resistance from its 20-day (blue line) and 50-day (red line) moving averages, consider the following credit spread trade that relies on GE staying below $114 (green line) through expiration in 6 weeks:

Buy to Open the GE 8 Dec 116 call (GE231208C116)

Sell to Open the GE 8 Dec 114 call (GE231208C114) for a credit of $0.40 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $106.35 close. Note that I’m giving a little extra room on the entry credit. Unless GE falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $38.70. This trade reduces your buying power by $200, making your net investment $161.30 per spread ($200 – $38.70). If GE closes below $114 on Dec. 8, the options will expire worthless and your return on the spread would be 24% ($38.70/$161.30).

**Our QQQ portfolio is up more than 70% in 2023! Our MSFT portfolio is up more than 55%! Don’t be left behind … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Where’s the Beef?

October 10, 2023

With earnings reports virtually dried up this week and wanting to stay on the bearish side, I had to go back a few weeks to find reports that failed to impress the Street. One name that popped up was a stock that we successfully played (28% profit) for a bullish winner back in March – Darden Restaurants (DRI), the sit-down restaurant chain conglomerate that includes Olive Garden, LongHorn Steakhouse, Capital Grille, and the recently acquired Ruth’s Chris Steak House.

DRI reported earnings a couple of weeks ago. The numbers were solid, as the company beat estimates on both the top and bottom lines. Same-restaurant sales also handily beat expectations. Moreover, sales and profits were higher than a year earlier. The only negatives were slowing growth in its fine-dining holdings and some concern over its aggressive expansion plans amid a potential recessionary environment.

Analysts seemed unmoved by the seemingly positive news. The report was met with a mix of target price upgrades and more numerous downgrades. This left the average target in the $160-170 range, well above Friday’s $137 close. With no ratings changes, analysts remain firmly in the buy/outperform camp.

Perhaps analysts should take closer note of DRI’s stock chart and post-earnings performance. After hitting an all-time high in late July, the stock is down 21% and logged its lowest close in nearly a year on Friday. I’ll point out that the S&P 500 is down just 5% over the same time frame. This slump has been perfectly guided by the 20-day moving average, a trendline the stock hasn’t closed above in more than two months. Also, for technical wonks, the 50-day moving average is crossing below the 200-day moving average, also known as the “death cross.”

This bearish trade is based on the stock’s continued slump even after the good earnings results. With analysts perhaps too optimistic, it’s reasonable to expect some target price reductions, if not some ratings downgrades that could further pressure the share price.

Finally, the 20-day resistance is hard to ignore, which is why we’re playing a call spread with the short call strike sitting just above this trendline. Note that this trade has a smaller return than most because I wanted the short strike to be above the 20-day. Thus, we have a larger cushion of safety and greater probability of profit.

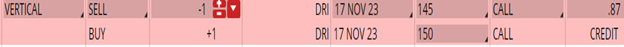

If you agree that the stock will continue its downtrend based on the resistance from its 20-day moving average (blue line), consider the following credit spread trade that relies on DRI staying below $145 (red line) through expiration in 6 weeks:

Buy to Open the DRI 17 Nov 150 call (DRI231117C150)

Sell to Open the DRI 17 Nov 145 call (DRI231117C145) for a credit of $0.85 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $136.94 close. Unless DRI falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $83.70. This trade reduces your buying power by $500, making your net investment $416.30 per spread ($500 – $83.70). If DRI closes below $145 on Nov. 17, the options will expire worthless and your return on the spread would be 20% ($83.70/$416.30).

Happy trading,

Jon L

**Our QQQ portfolio is up more than 70% in 2023! Our MSFT portfolio is up around 30%! Overall, we’re beating the S&P. Don’t be left behind … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Cold and Soggy

September 25, 2023

Cold and Soggy

There were a few interesting earnings announcements this week, even though we’re in the quiet period for earnings reports (things start to ramp up again in three weeks). In fact, I had three bearish plays to choose from. That’s a good thing since we currently have three bullish and three bearish trades open, and I feel like the bears need a little more weight after the past week’s Fed-infected price action.

The trade this week is on prepared-food giant General Mills (GIS), which owns several iconic cereal brands along with such names as Betty Crocker, Blue Buffalo, Pillsbury, Progresso, Green Giant and Yoplait. GIS reported earnings numbers on Wednesday before the open that were filled with a lot of “buts.” Sales increased 4% due to higher prices, but volume was lower. Net income beat the consensus expectation but fell 18% from a year ago. GIS executives are bullish on their pet food segment but sales for the quarter were flat. Moreover, some analysts feel that consumers are reaching their limit on rising food costs. And GIS’s CFO said that the company’s operating profit margin will not improve this year.

All in all, it was not a great report, which is perhaps why the stock was hit with a few price target cuts. At least there were no ratings downgrades. Analysts on the whole are neutral toward the stock, while the average target price is in the $70-75 range compared to Friday’s close near $65.

Perhaps analysts would be a bit more skeptical if they took a quick glance at GIS’s chart, which shows the stock plunging 30% in the past four months. This descent has been expertly guided by the 20-day moving average, a trendline the stock has closed above just four times since mid-May. This resistance was evident the two days after earnings this week, when the shares failed to pierce the 20-day with early rallies. Note that the short call strike of our spread sits above this trendline.

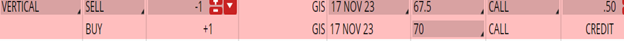

If you agree that the stock will continue its downtrend after an uninspiring earnings report and remain below its 20-day moving average (blue line), consider the following credit spread trade that relies on GIS staying below $67.50 (red line) through expiration in 8 weeks:

Buy to Open the GIS 17 Nov 70 call (GIS231117C70)

Sell to Open the GIS 17 Nov 67.5 call (GIS231117C67.5) for a credit of $0.45 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $64.82 close. Unless GIS falls sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $43.70. This trade reduces your buying power by $200, making your net investment $156.30 per spread ($200 – $43.70). If GIS closes below $67.50 on Nov. 17, the options will expire worthless and your return on the spread would be 28% ($43.70/$156.30).

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – Health Bear … Sort Of

September 12, 2023

Health Bear … Sort Of

With no notable earnings reports this week, we’re turning to an ETF that’s done little of late. It’s the SPDR Health Care ETF (XLV), which holds such heavyweights as UnitedHealth Group (UNH), Eli Lilly (LLY), Merck (MRK), Johnson & Johnson (JNJ) and Amgen (AMGN) among its top 10 holdings. This trade is a bearish credit spread, though I’m not particularly bearish on the sector. I’m not bullish, either. But that’s the beauty of credit spreads. You can be more neutral than directional and still collect a maximum profit so long as the short strike remains out of the money. It’s a forgiving strategy that caters to those who don’t have a strong directional bias.

I’m using a bearish call spread for this trade because the overhead 135 level has proven difficult for XLV to overcome throughout most of 2023. In fact, the ETF has closed above this mark only a handful of times since January. Recent attempts to take out 135 were rejected in April, August and July.

Although XLV currently sits below all its major moving averages, it hasn’t respected these trendlines for support or resistance for much of the year. So, even though the 20-day, 50-day and 200-day moving averages lie between the current XLV price and the 135 level, I’m not relying on their potential for resistance. This is more about the 135 level acting as a top in recent months.

Note that this trade extends into the start of the next earnings season. In fact, four of XLV’s top 10 holdings, including UNH and JNJ, report before the spread expires on Oct. 20. However, given XLV’s performance this year (down around 3%) and the fact that it’s gone nowhere for seven months, I’m not expecting earnings from a few XLV names to give the ETF a huge shot in the arm prior to expiration.

If you agree that XLV will continue its “meh” performance, consider the following credit spread trade that relies on XLV staying below $135 (blue line) through expiration in 6 weeks:

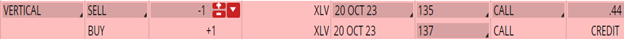

Buy to Open the XLV 20 Oct 137 call (XLV231020C137)

Sell to Open the XLV 20 Oct 135 call (XLV231020C135) for a credit of $0.40 (selling a vertical)

This credit is $0.04 less than the mid-point price of the spread at Friday’s $132.06 close. Unless XLV sinks sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $38.70. This trade reduces your buying power by $200, making your net investment $161.30 per spread ($200 – $38.70). If XLV closes below $135 on Oct. 20, the options will expire worthless and your return on the spread would be 24% ($38.70/$161.30).

**We continue to beat the market in 2023. Don’t miss out on the profits … now you can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Option Trade of the Week – This Stock is No Stretch

September 5, 2023

With the market throwing off bullish vibes this week, we’re going with another bullish trade on one of the few notable names that reported earnings this week: athletic apparel maker Lululemon Athletica (LULU). The company reported solid numbers after the bell on Thursday, including an 18% revenue jump that surpassed the analyst estimate. Earnings also handily beat expectations. To complete the trifecta, full-year revenue and earnings guidance came in above the analyst estimate.

Analysts were seemingly thrilled with the numbers, as a slew of price target increases poured in. But many raised the price by only a few dollars, which is meaningless for a $400 stock. After the flurry, the new average target price stands only around 3% above Friday’s close. And there were no ratings changes, leaving the current consensus in the buy/outperform category.

So, while analysts appear bullish, nobody seems willing to bet the mortgage payment on LULU. I’m fine with that, however, as I hesitate to jump on a bandwagon that’s already full. I like to see some room for upgrades and target price increases.

Traders apparently thought differently, pushing LULU up 6% on Friday to an 18-month high. It also propelled the stock above a trading range that has captured most of the price moves of the past five months. Note in the chart how the 20-day and 50-day moving averages have combined forces near the 380 level. I expect these trendlines to rise above the top of the range around $385 within the next week or two. That should provide a multi-layered tier of support to keep the short put of our spread out of the money.

The other technical driver of this trade is the fact that LULU tends to stay flat for several weeks after earnings. That is, the stock doesn’t tend to stray too far from its initial post-earnings move. Given that we have around a 5% cushion combined with the trading range and potential trendline support, I like the odds of LULU staying above the key $385 mark through expiration.

If you agree that the stock will respect the top of its trading range, consider the following credit spread trade that relies on LULU staying above $385 (green line) through expiration in 6 weeks:

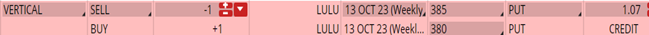

Buy to Open the LULU 13 Oct 380 put (LULU231013P380)

Sell to Open the LULU 13 Oct 385 put (LULU231013P385) for a credit of $1.05 (selling a vertical)

This credit is $0.02 less than the mid-point price of the spread at Friday’s $404.19 close. Unless LULU surges at the open on Tuesday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $103.70. This trade reduces your buying power by $500, making your net investment $396.30 per spread ($500 – $103.70). If LULU closes above $385 on Oct. 13, the options will expire worthless and your return on the spread would be 26% ($103.70/$396.30).

**You can save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Success Stories

I have been trading the equity markets with many different strategies for over 40 years. Terry Allen's strategies have been the most consistent money makers for me. I used them during the 2008 melt-down, to earn over 50% annualized return, while all my neighbors were crying about their losses.

~ John Collins

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube