Earlier Years

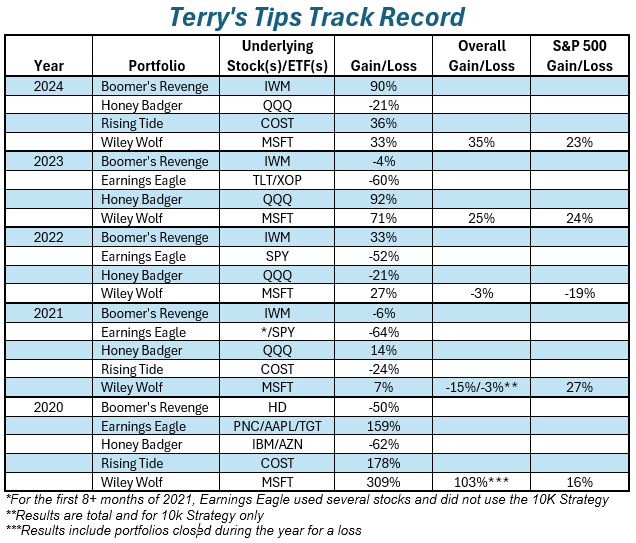

2019: Our results for 2019 were extraordinary. It was a good year for the market in general. The S&P 500 (SPY) gained about 29%. Just about any equity investment probably made money. However, the average gain for our 10K Strategy portfolios exceeded 103%, or well more than 3 times as great as the market as a whole.

2018: The success of the 10K Strategy depends on selecting underlying stocks or ETFs that stay flat or move higher. 2018 was the only year in the past 10 years when the market fell during the calendar year. This was especially true in the last quarter when prices fell across the board. Our 10K Strategy portfolios all lost money in 2018, a dramatic difference from 2017 when the composite average portfolio gained over 113%. Our worst 2018 performer was based on Facebook (FB), which fell from a high above $218 to end at $135, a drop of 38%. Our portfolio lost over 90%, a huge reversal from the 700%+ gain that it had enjoyed in 2017 (see below).

We carried 10 portfolios in 2018, many of which were experiments with strategies totally different from the basic 10K Strategy that has become the only strategy that we currently use. It was a down year for the market, and our composite loss for the year was 39.9% after culling out the portfolios which bore no resemblance to our basic strategy or which did not operate for the entire year.

2017: The composite average of our 10 portfolios gained 113% for 2017, just about the best year we have enjoyed in our 16 years of publishing Terry’s Tips. Only one portfolio (Honey Badger) lost money.

A Word About Our Trading

We currently carry four portfolios that are available for auto-trading at Tradier or tastytrade (so you can follow a portfolio and never have to make a trade on your own). All portfolios can be carried in an IRA account. Paying subscribers can follow the results of all the portfolios. Some newsletters only reveal their winning portfolios to all subscribers, but at Terry’s Tips, we disclose every trade and every position for every portfolio at all times.

All results include commissions at the standard rate charged by Tradier for Terry’s Tips subscribers. Many newsletters conveniently (for them) do not include commissions when they report their trading results. Terry’s Tips has carried out real-time portfolios for subscribers to follow (or auto-trade if they wished) since 2003.

Option trading involves leverage, and leverage works in both directions. Gains (and losses) are often greater than changes in the market. However, we have tried to minimize the losses in down years so that our losses are less than those of the markets in general, and to enjoy greater gains than the markets in good years. Most of the time, we have been successful in carrying out these goals. Of course, we must remind everyone that past performance is no guarantee that future results will be as great as they have been in the past, in spite of our expectations that they will do just that.

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube