Shop

TERRY’S TIPS STOCK OPTIONS TRADING BLOG

April 1, 2024

Fool Me Once …

There was nothing on the weekly earnings docket that I considered trade worthy. Even the few names I recognized were either too low-priced, had lousy options or bid/ask spreads, or, most importantly, not giving me a good chart read. During slow earnings periods – which include next week and most of the following week – I look back at past trades to see how they look today. One that I like just happens to be the last trade we closed for a loss. But I whiffed so badly on it – I suggested a bearish trade and the stock cruised 20% higher – that I now like it as a bullish play.

The stock is Veeva Systems (VEEV), which provides cloud-based software for the health sciences industry. VEEV reported solid earnings results in late February, beating estimates on revenue and earnings per share. Guidance for the first quarter came up short on revenue, which may be why the stock stumbled a bit after the report.

Analysts were very clear in their view toward VEEV, handing the stock a boatload of target price increases. Maybe they’re trying to play catch-up because the current average target price – after all the increases – is right around Thursday’s closing price. Given that VEEV is a tech stock (though it’s considered in the healthcare sector), that’s an underwhelming endorsement for a stock that’s rallied 40% in less than four months. It’s not hard to see how more target price increases and perhaps a ratings change or two (the current average rating is a buy) could be in the offing.

There aren’t many charts prettier than VEEV’s daily chart. The stock has climbed steadily since an early December low, riding along the solid support of its 20-day moving average. How solid? The trendline has been tested no less than a half-dozen times and has allowed just one daily close below it. This trade is based on the uptrend and support continuing for the next several weeks, perhaps aided by some analyst love.

The 20-day moving average sits just below the 230 level, while the 50-day is at 220. VEEV offers only monthly options, with strikes every 10 points within the range we want. Therefore, I am forced to go with the May series and the 220 short strike. This is producing a little less credit – and thus return – compared to our usual trades. But that means the short strike is further out of the money (less risky).

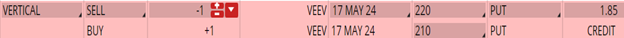

If you agree that the stock will continue to trade above its 20-day (blue line) moving average, consider the following credit spread trade that relies on VEEV staying above $220 (red line) through expiration in 7 weeks:

Buy to Open the VEEV 17 May 210 put (VEEV240517P210)

Sell to Open the VEEV 17 May 220 put (VEEV240517P220) for a credit of $1.80 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $231.69 close. Unless VEEV surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $178.70. This trade reduces your buying power by $1,000, making your net investment $821.30 per spread ($1,000 – $178.70). If VEEV closes above $220 on May 17, the options will expire worthless and your return on the spread would be 22% ($178.70/$821.30).

** We are crushing it! Our Costco (COST) portfolio was up 30% in the first quarter. Our Microsoft (MSFT) portfolio gained 15% (last year this portfolio returned more than 70%). And our IWM portfolio added nearly 20%. All in just one quarter.

Don’t be left behind … there’s still time to save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

March 5, 2024

Sunny Outlook

We’re headed back to the bullish side this week with a trade on First Solar (FSLR). The country’s largest solar module maker reported earnings on Tuesday after the bell. Earnings per share came in above estimates, while revenue fell short despite growing more than 15% year over year. The company guided earnings and sales that were in line with or slightly higher than the analyst consensus.

The stock jumped as much as 9% on the news before closing 3% higher. That’s in sharp contrast to other solar companies, which have been plagued by lower demand, high interest rates, regulatory changes and higher inventories. But FSLR managed to overcome those headwinds with stronger pricing power, something analysts see continuing in 2024.

The news was not met with any ratings changes, though there were a few target price increases. Depending on the source, FSLR’s average target price is in the $210-235 range, which is well above Friday’s $158 close. Given that the stock reached a high of $232 last May – its highest level in the past 25 years – these estimates may be a tad overexuberant.

My take on FSLR – based on the charts – is more conservative. The stock has gone nowhere in the past five months, travelling mostly between the 140 and 175 levels. The 20-day and 50-day moving averages, which have provided nothing in terms of support or resistance, are horizontal and of little use.

Given the positive earnings results and outlook, we’re looking for the bottom of this trading range continuing to hold at 140, a level the stock has closed below just seven times going back to October 2022. The short strike of our put spread is at 140, which is more than 11% below Friday’s close. Because we’re going so far OTM with this trade, the credit and max return are somewhat lower than most of our trades. Less risk, less reward.

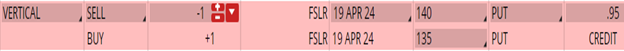

If you agree that the stock will continue respecting the bottom of its trading range, consider the following credit spread trade that relies on FSLR staying above $140 (blue line) through expiration in 7 weeks:

Buy to Open the FSLR 19 Apr 135 put (FSLR240419P135)

Sell to Open the FSLR 19 Apr 140 put (FSLR240419P140) for a credit of $0.90 (selling a vertical)

This credit is $0.05 less than the mid-point price of the spread at Friday’s $158.05 close. Unless FSLR surges at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $88.70. This trade reduces your buying power by $500, making your net investment $411.30 per spread ($500 – $88.70). If FSLR closes above $140 on Apr. 19, the options will expire worthless and your return on the spread would be 22% ($88.70/$411.30).

** We are crushing it! Our Costco (COST) portfolio is up 23% already this year. Our Microsoft (MSFT) portfolio is up 14% (last year this portfolio returned more than 70%). Don’t be left behind … there’s still time to save more than 50% on a monthly subscription to Terry’s Tips. Just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off.**

January 31, 2024

Dear [[firstname]],

Here’s your Option Trade of the Week as included in this past weekend’s Saturday Report for our Terry’s Tips Premium Members.The credit from last week’s trade ran away from us pretty quickly, so I opted to pass on sending it out knowing that you wouldn’t get the minimum credit. This week’s trade – which gets us back on a bullish track – has a better chance for entry. So, I’m hoping that you can make it work.

Before that, though, I have to tell you that our Microsoft (MSFT) portfolio – we call it Wiley Wolf – is on fire. With January in the books, we are already up more than 22% while the stock itself is up less than 6%. In fact, we booked more than half that huge gain just today after MSFT’s earnings!

How did we do it? The same way we bagged 70% and 92% profits using MSFT and QQQ last year – Dr. Terry Allen’s 10K Strategy. This market-beating strategy has proven itself over the past two decades … and this year looks to be no exception.

You can’t afford to miss out on these profits. Resolve to make 2024 your best trading year ever – and learn about Terry’s unique strategy – by becoming a Premium Member of Terry’s Tips.

For our loyal newsletter subscribers (that’s you), I’m of course keeping the sale going that saves you more than 50% on a monthly subscription to Terry’s Tips. Plus, I’m adding a promise that this rate will never increase. I won’t make this promise forever, though, so now is the time to get in on the action … and profits.

As a Premium Member to Terry’s Tips, you’ll get …

- A month of all trade alerts in our four portfolios, giving detailed instructions for entering and exiting positions. Trade one portfolio (I recommend Wiley Wolf) or all four. It’s up to you.

- Four to five (depending on the month) weekly issues of our Saturday Report, which shows all the trades and positions for our four portfolios, a discussion of the week’s trading activity and early access to our Option Trade of the Week.

- Instructions on how to execute the 10K Strategy on your own.

- Access to our autobrokers to make trades on your behalf.

- A 14-day options tutorial on the opportunities and risks of trading options.

- Our updated 10K Strategy white paper, a thorough discussion of the strategy basics and tactics.

- Full-member access to all our premium special reports that can make you a wiser and more profitable options trader.

- Annual subscription available for more than 50% savings

And, for a limited time, I am including a Special Bonus. Terry Allen has condensed his 30 years of options trading experience into an eBook – Making 36% – A Duffer’s Guide to Breaking Par in the Market Every Year, in Good Years and Bad. Learn a different way to trade using Terry’s unique and decades-tested 10K Strategy. This book is normally $9.98 on our website (and $19.95 on Amazon), but I will personally send you the digital version for free with a paid subscription.

To become a Terry’s Tips Premium Member, just Click Here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. You can cancel after a month but, of course, keep all the valuable reports and the book.

I look forward to having you join in the fun and profits! Now on to the trade …

It’s Intuitive

Lots to chew on this week with earnings season in full swing, so let’s dive right in with a bullish trade on Intuitive Surgical (ISRG). The company makes surgical instruments, notably the da Vinci robot, that emphasize minimal invasiveness. ISRG reported Tuesday after the bell, easily beating on the top (profit) and bottom (revenue) lines. Earnings per share increased 30% from a year earlier, while revenues improved more than 16%. Much of this growth came from a 21% increase in da Vinci procedures.

Analysts were quick to raise their target prices, with at least a half dozen trying to beat each other to the punch. These were not minor increases, either. One firm raised its target by 35%, while several others were around 15%. That equates to increases of $30 to more than $100 … not bad for a $375 stock. Oddly, there were no rating increases, keeping ISRG at a solid buy rating. However, there are few holds on the stock, leaving some room for upgrades.

Also odd is the fact that the stock fell as much as 3.4% on Wednesday, though it closed just 0.4% lower. That’s the smallest move after earnings in more than 11 years. There wasn’t much action after that, as ISRG gained about a percent on Thursday and Friday. The stock reaction might give one pause given the strong earnings results. However, the muted move makes more sense since the company already released bullish guidance numbers a couple of weeks ago. That caused the shares to pop more than 10%, making this week’s news less impactful.

The guidance surge pulled the stock away from its 20-day moving average, a trendline that has guided a 47% rally over the past three months. The shares spent a few days just below the 20-day in early January, the only time they were staring up at the trendline since crossing above it on November 1. We are therefore using the 20-day as the basis of this week’s bullish trade. The short put strike of our spread sits just below the 20-day, which is about 6% beneath Friday’s close.

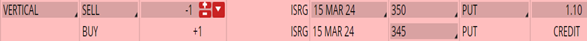

If you agree that the stock will continue trading above, or at least near, the 20-day moving average (blue line), consider the following credit spread trade that relies on ISRG staying above $350 (red line) through expiration in 7 weeks:

Buy to Open the ISRG 15 Mar 345 put (ISRG240315P345)

Sell to Open the ISRG 15 Mar 350 put (ISRG240315P350) for a credit of $1.00 (selling a vertical)

This credit is $0.10 less than the mid-point price of the spread at Friday’s $374.76 close. Unless ISRG surges sharply at the open on Monday, you should be able to get close to that price.

The commission on this trade should be no more than $1.30 per spread. Each spread would then yield $98.70. This trade reduces your buying power by $500, making your net investment $401.30 per spread ($500 – $98.70). If ISRG closes above $350 on Mar 15, the options will expire worthless and your return on the spread would be 25% ($98.70/$401.30).

Testimonial

It is often said that options are to stock trading as chess is to checkers. I was looking to find the chess master amongst the checker’s champs, and Terry is the one. Looking for very smart yet understandable way to trade options? Look no further. ~ Phil Wells

Remember to click here, select Sign Up Now and use Coupon Code D21M to start a monthly subscription to Terry’s Tips for half off. And get Terry’s eBook for free.

Any questions? Email Jon@terrystips.com. Thank you again for being a part of the

Terry’s Tips newsletter.

Making 36%

Making 36% – A Duffer's Guide to Breaking Par in the Market Every Year in Good Years and Bad

This digital book may not improve your golf game, but it might change your financial situation so that you will have more time for the greens and fairways (and sometimes the woods).

Learn why Dr. Allen believes that the 10K Strategy is less risky than owning stocks or mutual funds, and why it is especially appropriate for your IRA.

Error: Contact form not found.

Member Login | Programs and Pricing | Testimonials | About Us | Terms and Conditions | Accessibility Statement | Privacy Policy | Site Map

Options are not suitable for all investors as the special risks inherent to options trading my expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks of Standardized Options before investing in options

© Copyright 2001-2022 Terry's Tips, Inc. dba Terry's Tips

235 Primrose Lane, Ferrisburgh, VT 05456

Follow Terry's Tips on Twitter

Like Terry's Tips on Facebook

Watch Terry's Tips on YouTube